Shock of Interest Rate Hike Spreads... Buying Momentum Disappears

Seoul and Nationwide Apartment Prices Fall Sharply

Apartment Sales Supply-Demand Index Declines for 6 Consecutive Weeks

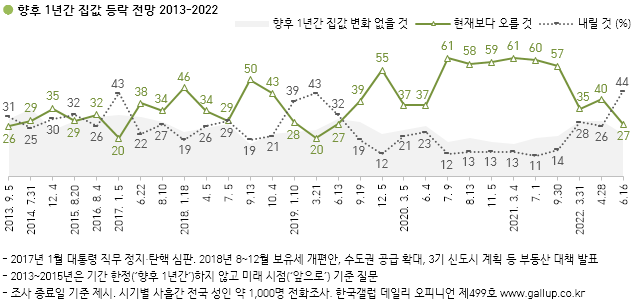

Regarding the outlook for house price fluctuations over the next year, 44% of the public responded that prices would fall. Only 27% said they would rise. This is the first time since the first half of 2019 that the majority expects house prices to decline.

On the 18th, Gallup Korea surveyed 1,000 people nationwide aged 18 and over from the 14th to the 16th about their outlook on house prices for the next year. The results showed that 44% expected prices to 'fall,' while 27% expected them to 'rise.' This level is similar to that of the first half of 2019, marking the first time in three years that the outlook for a decline surpassed that for an increase.

The expectation of rising house prices was around 60% from the second half of 2020 through 2021 but plummeted sharply after the presidential election in March this year. In this survey, it fell below 30% for the first time since June 2019.

Twenty-two percent anticipated 'no change,' and 7% withheld their opinion.

Since the June 2017 real estate measures (6.9 Real Estate Measures), every time related policies were announced, house prices in key interest areas experienced repeated cycles of temporary stagnation followed by surges and overheating. This pattern was clearly reflected in the house price outlook surveys as well, with expectations of rising prices increasing annually: 50% in September 2018, 55% in December 2019, and 61% in early July 2020. Afterward, until September 2021, the outlook remained steady regardless of any government measures. The lowest expectation for rising house prices during the Moon Jae-in administration was 20% in March 2019.

The margin of error for this survey is ±3.1 percentage points at a 95% confidence level. The survey was conducted via telephone interviews, with 90% on mobile phones and 10% on landlines, and the response rate was 8.7%.

Recently, the real estate market has seen a sharp contraction in buying demand due to overlapping factors such as interest rate hikes and theories of peak house prices.

According to the Korea Real Estate Board, this week’s apartment sales-to-supply index in Seoul was 88.8, down 0.6 points from last week’s 89.4.

The sales-to-supply index is calculated by the Real Estate Board based on surveys of member real estate agencies and the number of online listings, quantifying the ratio of demand (buyers) to supply (sellers). The lower this index is below the baseline of 100, the more sellers there are compared to buyers in the market.

After the presidential election in March this year, the sales-to-supply index rose close to the baseline but began to decline starting from the implementation of the temporary exclusion of multi-homeowners from the capital gains tax surcharge on the 10th of last month. It has shown a downward trend for six consecutive weeks up to this week.

With an increase in tax-saving listings from multi-homeowners, ongoing interest rate hikes, and concerns about falling house prices, buyers have taken a wait-and-see approach, resulting in more sellers than buyers in the market.

This week, the Korea Real Estate Board reported that apartment prices in Seoul fell by 0.03%, marking a decline for three consecutive weeks, with the rate of decrease larger than last week’s -0.01%.

According to a survey by the real estate big data company Asil, as of this day, the number of apartment listings in Seoul was 63,934, an increase of 1.7% compared to a week ago?the highest growth rate among all provinces nationwide.

A Korea Real Estate Board official stated, "While some areas have an accumulation of listings, due to concerns over high inflation and interest rate burdens, transactions are mainly limited to a very small number of urgent sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.