May US Retail Sales Turn Down

Impact of High Inflation and Monetary Tightening

Downward Pressure on Economy Expected to Increase in Second Half

[Asia Economy Reporter Minji Lee] Amid high inflation and supply shortages leading to a decline in retail sales, analysis suggests that in the second half of the year, the pressure on consumption slowdown will expand due to the effects of high inflation and interest rate hikes.

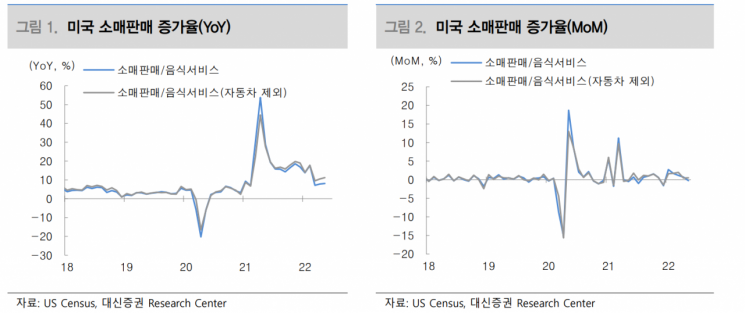

According to the financial investment industry on the 18th, U.S. retail sales in May fell by -0.3% compared to the previous month, marking the first decline this year. Not only was this 0.2% below market expectations, but considering the April figure was revised from 0.9% to 0.7%, it was significantly weak.

The deterioration in the May retail sales indicator is largely due to China's lockdown measures. Automobile and parts sales plunged 3.5% month-on-month, with passenger car and light truck sales in May dropping sharply by 11.2% compared to the previous month. Rather than a decrease in demand, supply disruptions were the main cause, as used car prices showed a rebound trend.

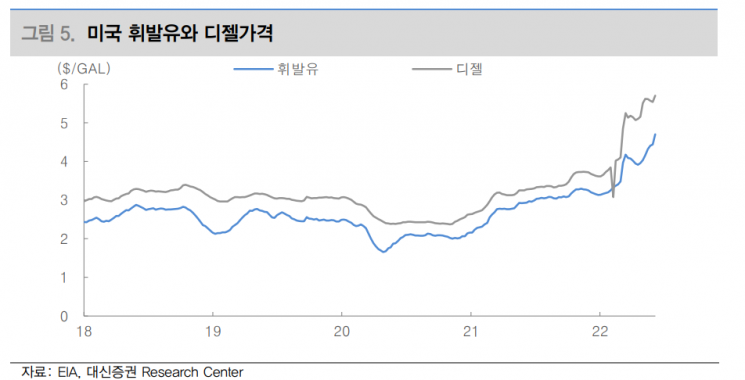

A notable point in this announcement is that household spending capacity has significantly decreased as the price increases of essential goods such as groceries and gasoline have expanded. Gasoline prices surged 7.8% month-on-month, leading to a 4% increase in sales, but excluding gasoline, total retail sales fell by 0.7% compared to the previous month. Service consumption maintained an increase for the fourth consecutive month at 0.7%.

By category, durable goods consumption, such as furniture and electronics, declined sharply. Considering that durable goods consumption is sensitive to economic fluctuations and that the University of Michigan Consumer Sentiment Index recorded an all-time high in June, it is estimated that the recent economic slowdown also influenced the decrease in durable goods consumption. Since furniture and electronics are items related to housing activity, the sharp decline in new home sales in May is analyzed to be connected.

Da-eun Lee, a researcher at Daishin Securities, said, “With increased volatility in economic indicators, it remains to be seen whether the decline in retail sales will continue. Since automobile and parts sales, which had a significant impact this month, are showing signs of supply chain disruptions easing, consumption may increase further, so it is difficult to say that demand has entered a slowdown phase. Also, since goods consumption has decreased according to Personal Consumption Expenditures (PCE), it is necessary to examine how much service consumption has increased.”

What is certain is that the pressure on demand slowdown is intensifying as we move into the second half of the year. Signs of consumption slowdown due to inflation have already begun to appear, and the impact of high inflation is likely to continue until the end of this year. Researcher Lee explained, “According to the Fed’s dot plot, the benchmark interest rate will be rapidly raised to a level significantly above the neutral rate (2.5% as of June) by the end of this year,” adding, “The steep rise in borrowing costs and the downturn in asset markets will negatively affect household sentiment and consumption.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.