Broadcasting Business Revenue Share: IPTV, Terrestrial, Home Shopping PP in Order

Operating Profit Increased 23.2% Year-on-Year to 3.7699 Trillion Won

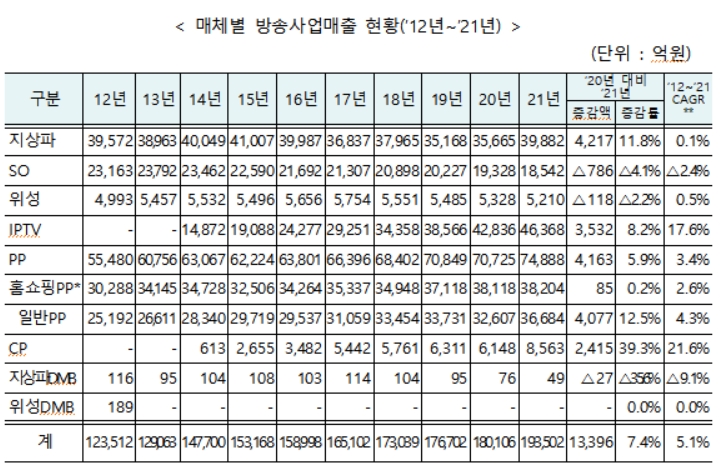

[Asia Economy Reporter Lim Hye-seon] Last year, the broadcasting business revenue of domestic broadcasters reached 19.3502 trillion KRW, an increase of 7.4% (1.3396 trillion KRW) compared to the previous year. By business group, Internet TV (IPTV), terrestrial broadcasting, broadcasting channel usage providers (PP), and content providers (CP) saw an increase in broadcasting revenue, while satellite broadcasting and cable TV (SO) experienced a decline.

On the 14th, the Korea Communications Commission announced the results of the survey on the financial status of broadcasting operators last year. The survey covered 352 operators who submitted their financial status data at the end of last year.

According to the KCC, the market share of broadcasting business revenue by medium was IPTV (24.0%), terrestrial broadcasting (20.6%), home shopping PP (19.7%), general PP (19.0%), SO (9.6%), CP (4.4%), and satellite (2.7%). Home shopping PP, which held the largest share of total revenue in 2020, dropped to third place this year.

Compared to the previous year, the share of home shopping broadcasting business revenue, broadcasting subscription fees, and terminal device rental revenue decreased, while the share of advertising revenue and program sales revenue increased. In particular, the share of broadcasting advertising revenue rose from 15.1% to 16.1%. Broadcasting advertising revenue increased by 15.0% (407.5 billion KRW) year-on-year to 3.1247 trillion KRW. PP recorded 1.6598 trillion KRW, up 13.4% (196.5 billion KRW), and terrestrial broadcasting recorded 1.2097 trillion KRW, up 20.8% (208.4 billion KRW). IPTV increased by 4.0% (4.2 billion KRW) to 107.1 billion KRW. Meanwhile, SO and satellite broadcasting recorded 109.0 billion KRW and 33.0 billion KRW, down 4.8% (5.5 billion KRW) and 0.7% (0.2 billion KRW), respectively.

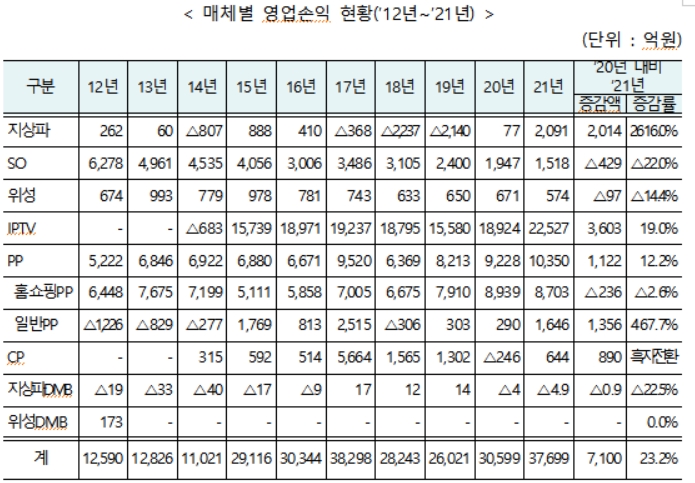

The operating profit of all broadcasting operators was 3.7699 trillion KRW, up 23.2% from the previous year. Terrestrial broadcasting, which succeeded in turning a profit for the first time in four years since 2016, had the highest growth rate at 2616.0%. Terrestrial broadcasting had a deficit of 214 billion KRW in 2019 but turned a profit with 7.7 billion KRW in 2020. Last year, operating profit reached 201.4 billion KRW. General PP (467.7%) and IPTV (19.0%) also saw increases in operating profit. CP, which had a deficit of 24.6 billion KRW in 2020, posted a profit of 64.4 billion KRW last year. On the other hand, platform operators excluding IPTV showed a declining trend in operating profit. SO (-22.0%), satellite (-14.4%), and home shopping PP (-2.6%) saw decreases in profit.

Program production costs generally increased. Terrestrial broadcasting spent 2.7624 trillion KRW on production costs, up 4.7% (124.6 billion KRW) from the previous year. KBS and SBS invested 993.8 billion KRW and 551.1 billion KRW in production costs, up 7.2% and 3.3%, respectively. MBC spent 474.9 billion KRW on production costs, down 3.2%. CP increased production costs by 121.9% to 250.3 billion KRW, and PP invested 2.1364 trillion KRW, up 9.4%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.