[Asia Economy Reporter Changhwan Lee] Tesla's third-generation auto insurance introduced last year in the United States is gaining attention locally for not only reducing premiums but also decreasing accidents.

According to the Insurance Development Institute's report titled "The Emergence of 3rd Generation Auto Insurance, BBI, and Domestic Status" on the 14th, Tesla launched behavior-based insurance (Behavior Based Insurance, BBI) last October in five states including Texas.

Behavior-based insurance is a third-generation auto insurance model that collects and analyzes driving habit information through cameras installed in vehicles, offering up to a 60% discount on premiums.

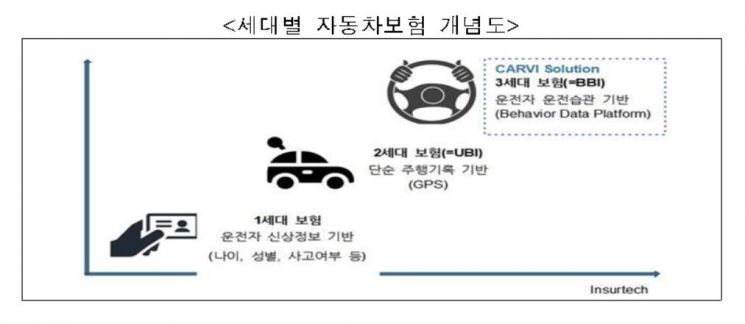

The first-generation auto insurance was based on personal information such as the driver's age, gender, and accident history; the second generation added driving records; and the third generation differentiates premiums by collecting actual driving habits such as speeding, lane departure, and sudden braking.

According to analysis by U.S. insurtech company Zendrive, BBI products not only reduce accident risk but also increase the efficiency of accident handling. As drivers' habits improve through BBI products, the likelihood of accidents decreased by 49%.

Real-time detection of accident occurrence and damage extent has also shortened the time required for accident cause investigation, accident reporting, and insurance payment.

Unlike the United States, where third-generation auto insurance has been fully implemented, South Korea is still in the early stages of adoption. Due to incomplete related regulations and technical limitations, major insurers are reportedly still deliberating internally.

However, there is an active atmosphere of adopting related technologies mainly among new insurance companies. Internet-specialized insurer Carrot General Insurance launched the safe driving reward service "Carrot Members Auto" last month.

Carrot Members Auto is characterized by an upgrade from the existing safe driving point service. Subscribers can check their safe driving index, accumulate and use points through the Carrot app, and receive useful information related to mobility life.

By analyzing driving data, users can earn points based on driving evaluations each time they drive and participate in various safe driving missions to receive additional benefits. Carrot General Insurance emphasized that this is a service adopting BBI technology.

Insurtech startup CARVI also collects driver data and evaluates it by calculating safe driving scores through its AI-based video recognition engine developed in-house.

The safe driving score is based on factors such as distance from the car ahead, speeding and lane departure frequency on curves, and the number of traffic signal violations. It is explained that this evaluation is effective because it assesses driver data based on driving context rather than simply counting violations.

Another domestic startup, Gogo F&D, is attempting to commercialize an IoT device exclusively for two-wheeled vehicles called "Gogo Safe." When this IoT device is attached to a two-wheeler, it detects tilt, sudden acceleration/braking, and traffic signal violations to calculate a driving score for each driver.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.