KOSPI 200 Futures Sold 14,000 Contracts, Recording Highest Level in 10 Months

Government Bond Futures Continuously Net Sold 10,000 Contracts Daily... 55,000 Contracts Sold in One Month

[Asia Economy Reporter Lee Seon-ae] Warning signals of foreign capital outflow are growing in the Korean stock and bond markets. In the stock futures market, large-scale net selling has occurred for the first time in 10 months, withdrawing funds. In the bond futures market, foreign capital is also flowing out like an ebb tide. This is interpreted as a preemptive response to the extremely negative outlook on the Korean financial market and economic growth potential.

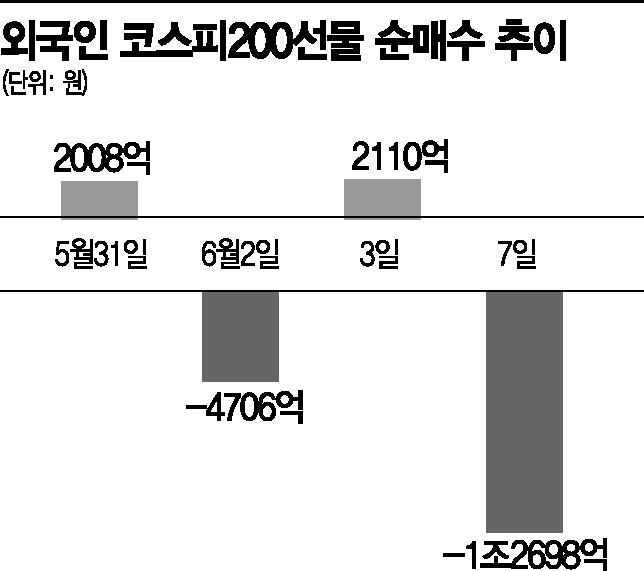

According to the Korea Exchange on the 8th, foreigners net sold 14,610 contracts of KOSPI200 futures the previous day. In terms of value, this amounts to 1.2698 trillion won. This is the largest figure since August 10 last year, when 15,982 contracts (1.7158 trillion won) were net sold. The fact that foreigners withdrew large-scale funds from the futures market indicates a negative view of the market. Experts see this as withdrawing from the highly liquid Korean market, anticipating worsening market indicators due to inflation. In particular, selling more than 10,000 contracts in a single day is evidence that foreign investors' sentiment is rapidly shaken. Jeon Gyun, a researcher at Samsung Securities, said, "With interest rates rebounding and inflationary pressures still high, foreigners are preemptively responding."

Labor Gil, a researcher at Shinhan Financial Investment, said, "Volatility is expected to increase this week as institutional investors participate heavily in spread trading," adding, "If foreigners roll over purchases in one quarter, confidence in index recovery can be gained, but we need to watch closely."

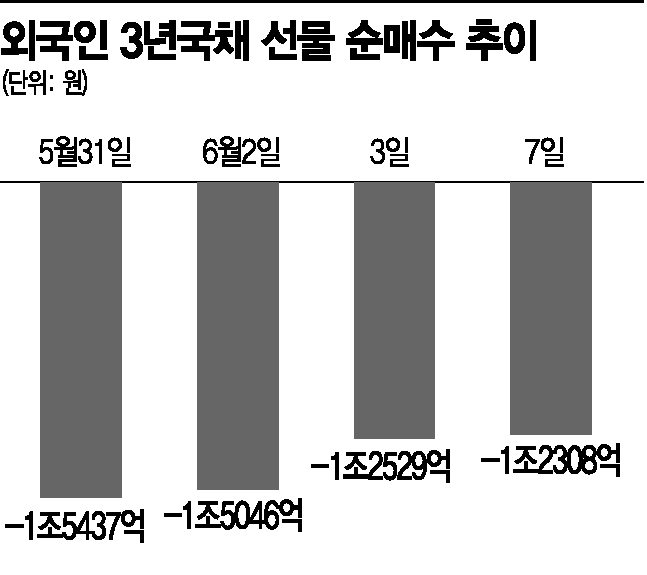

In the bond market, warning signals have grown as foreigners have been selling large volumes of 3-year government bond futures for consecutive days. They have been selling 10,000 contracts each for the past four trading days. On the 31st of last month, 14,625 contracts were sold, and on the 2nd and 3rd, 14,302 and 11,925 contracts were net sold respectively. In terms of value, this amounts to 1.5437 trillion won, 1.5046 trillion won, and 1.2529 trillion won. This is the first time since March 22 (1.2034 trillion won) that over 1 trillion won has been sold. Additionally, this is the first time since June last year that foreigners have shown a net selling trend exceeding 10,000 contracts for three consecutive trading days. The previous day also saw net selling of 11,733 contracts (1.2308 trillion won). The net selling volume over the past month reached 55,544 contracts (5.8522 trillion won).

This is interpreted as a move reflecting the Bank of Korea's hawkish (monetary tightening preference) stance and concerns about economic slowdown. Experts believe that the Bank of Korea is raising interest rates to a high level due to the very high inflation rate, and there is a judgment that the economic slowdown trend will intensify. Since the May Monetary Policy Committee meeting, hawkish reports on the Korean market by foreign investment banks (IBs) have been published one after another.

Jung Dae-ho, a researcher at KB Securities, pointed out, "Market concerns stem from the possibility that the Bank of Korea will raise the base interest rate faster and higher, similar to the U.S. Federal Reserve during the stagflation period in the 1970s," adding, "Although the Bank of Korea lowered its growth forecast for this year from 3.0% to 2.7% in the revised outlook in May, there is a high possibility of further downward revision in the second half, and concerns about inflation-driven economic slowdown are also intensifying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.