"Government Urgently Needs to Strengthen Support for Electric Vehicle and Battery Cooperation in Emerging Markets"

[Asia Economy Reporter Park Sun-mi] Due to the rapid growth of China and Germany, the global export market share of Korean electric vehicles and lithium-ion batteries declined last year.

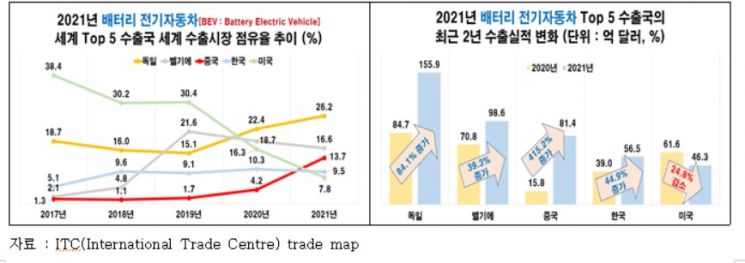

On the 8th, the Federation of Korean Industries analyzed the global electric vehicle and lithium-ion battery industries, which have been growing at an average annual rate of over 20%. As of 2021, among the world's top five electric vehicle exporting countries (Germany, Belgium, China, Korea, and the United States), China’s global export market share increased by 9.5 percentage points and Germany’s by 3.8 percentage points compared to 2020, while Korea, Belgium, and the United States saw decreases of 0.8, 2.1, and 8.5 percentage points respectively.

The nearly 10 percentage point increase in China’s global electric vehicle export market share last year was due to a 513.9% year-on-year increase in exports to the EU by Chinese companies such as Tesla’s Shanghai factory, SAIC Motor, BYD, and NIO. As a result, China’s share of the EU electric vehicle import market soared from 4.2% in 2020 to 15.9% in 2021, a vertical rise of 11.7 percentage points.

Regarding lithium-ion batteries, which are used in various applications such as electric vehicles, smartphones, and laptops, the world’s top five exporting countries in 2021 (Germany, China, Korea, Poland, and Hungary) saw China’s market share increase by 2.9 percentage points, Poland by 1.8, Germany by 1.2, and Hungary by 0.3 compared to 2020, while Korea’s share decreased by 2.0 percentage points.

The global market share of Chinese battery companies such as CATL, BYD, and CALB rose from 38.4% in 2020 to 48.7% in 2021, an increase of 10.3 percentage points. Conversely, the combined market share of Korea’s top three battery companies (LG Energy Solution, Samsung SDI, SK On) fell from 34.7% in 2020 to 30.4% in 2021, a decrease of 4.3 percentage points, and Japan (including Panasonic) dropped from 18.4% to 12.2%, a decline of 6.2 percentage points.

However, although Chinese companies such as CATL, BYD, and CALB hold the top global battery market share, their domestic market accounts for a larger portion than exports. Excluding the Chinese market, Korea’s share of the global battery market increased from 52.4% in 2020 to 57.0% in 2021, rising by 4.6 percentage points and maintaining its position as the world leader.

Kim Bong-man, head of the Federation of Korean Industries’ International Headquarters, stated, “China has established itself as the world’s leading electric vehicle powerhouse through abundant battery raw material reserves and government policy funding support for domestic battery companies.” He added, “The new government should strengthen electric vehicle and battery cooperation with the United States, which has been rebuilding its battery supply chain since last year.”

He also said, “Following the groundbreaking of an Indonesian electric vehicle battery plant in April this year by domestic companies for securing large-scale minerals such as nickel and battery cell production, and the establishment of a joint venture for cathode materials in Korea in May with a Chinese battery cathode material company, efforts are underway to secure market dominance through cooperation with emerging countries such as Indonesia and China.” He advised, “The new government should enhance policy support for companies targeting emerging markets like China and Indonesia, along with expanding domestic related infrastructure.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.