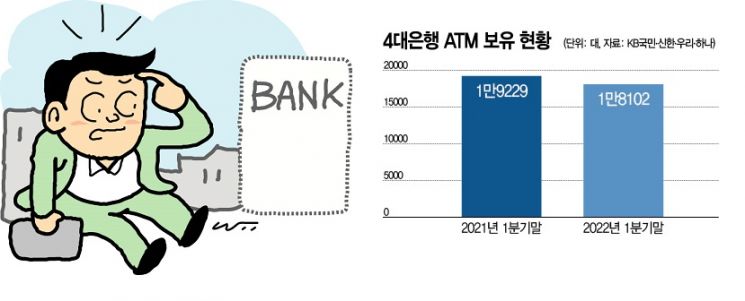

4 Major Banks' ATMs Decrease by 1,127

Profit Impact Drops as Cash Usage Declines

Cost Reduction Leads to Replacement with High-Function Devices

Bank ATMs are rapidly disappearing. Over the past year, the four major commercial banks have removed about three ATMs per day. The use of cash has declined due to credit cards and simple payment methods, and from the banks' perspective, ATMs have become a burden due to their high operating costs.

Disappearing ATMs

As of the end of the first quarter, the four major banks (KB Kookmin, Shinhan, Woori, Hana) held 18,102 ATMs, a decrease of 1,127 from 19,229 last year. Looking at each bank, KB Kookmin Bank reduced its ATMs from 5,589 to 5,252, a decrease of 337 units; Shinhan Bank cut 313 units from 5,422 to 5,109. Woori Bank and Hana Bank had 4,181 and 3,560 ATMs respectively, decreasing by 327 and 150 units each.

One of the main reasons for the disappearance of ATMs is the reduced demand due to declining cash usage. According to the Bank of Korea, the share of cash transactions among payment methods was 26.4% in 2019 before COVID-19, but dropped to 21.6% in 2021. Meanwhile, mobile card usage increased from 3.8% in 2019 to 9.0% in 2021, and credit card usage remained almost the same, at 43.7% in 2019 and 43.4% in 2021.

From the banks' perspective, the cost-effectiveness of operating ATMs is also a factor. It is known that the purchase and installation cost per ATM is close to 10 million KRW. ATM fees are around 1,000 KRW. It is difficult for commercial banks to raise fees to cover costs because internet-only banks like KakaoBank offer ATM fee exemptions, which could cause unnecessary controversy.

In terms of 'cost reduction,' the number of bank branches is also decreasing annually. The four major banks have 3,016 branches, down by 287 from last year. This means that bank branches are disappearing at a rate of about one every two days.

High-function devices filling the gap

The void left by the disappearing ATMs is being filled by high-function devices such as Smart Teller Machines (STM). Depending on the bank, STMs offer not only cash deposit and withdrawal, transfer, inquiry, and passbook updating functions available at ATMs, but also account opening through biometric authentication, check card issuance and reissuance, internet banking registration and cancellation, security media issuance, and bill payment.

Although STMs have higher installation, maintenance, and repair costs than ATMs, they automate and intelligentize tasks that were previously only possible at teller counters, resulting in significant intangible labor cost savings. Accordingly, commercial banks are actively expanding STM deployment. The number of STMs installed nationwide by the four major banks has increased by 85.4% to 395 units this year compared to the end of 2019, just three years ago.

Recently, video-exclusive consultation counters that enable real-time and remote loan services have also increased. The number of video-exclusive consultation counters at the four major banks rose from just six at the end of 2019 to 224 this year. These counters offer not only the functions of STMs but also consultations and subscriptions for various financial products such as funds, as well as personal loan consultations, far surpassing the capabilities of ATMs.

A representative from a commercial bank said, "As of last year, the cash usage ratio has dropped to around 20%, and with various fee exemptions for deposits, withdrawals, and transfers, banks have little incentive to maintain ATMs. High-function devices like STMs can replace a variety of tasks previously done at counters, so in the future, they will replace not only ATMs but also various branch and sub-branch locations."

Experts advise that while banks' cost-cutting measures such as reducing ATMs are inevitable, it is important to devise strategies to prevent inconvenience to financial consumers. Professor Seo Ji-yong of Sangmyung University’s Department of Business Administration said, "If reductions are made uniformly, consumer inconvenience will increase and the bank's reputation may decline in the long term. It is necessary to analyze and identify targets by branch and establish policies to continuously operate branches in areas with many seniors or high cash demand, focusing on selection and concentration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)