Yongsan and Gangnam Growth Slows, Nowon, Dobong, and Gangbuk Decline

Ilsan and Bundang First-Generation New Towns Continue Upward Trend

Apartment prices in Seoul have turned downward after 9 weeks. This is due to the convergence of factors such as the upcoming property tax base date (June 1), temporary exclusion from capital gains tax surcharges, and interest rate hikes, which have increased the number of urgent sale listings and reduced buying demand.

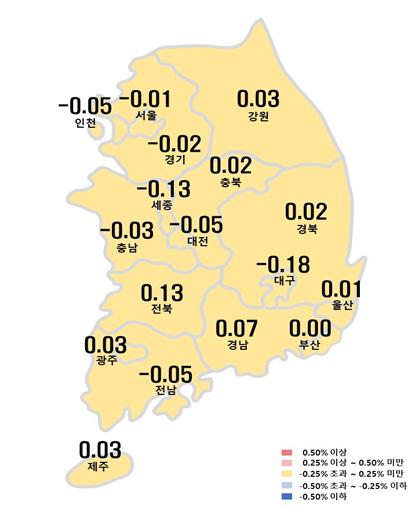

According to the National Real Estate Survey released by the Korea Real Estate Board on the 2nd, apartment prices in Seoul in the 5th week of May fell by 0.01% compared to the previous week. This is the first decline in Seoul apartment prices in 9 weeks since the survey at the end of March.

Apartment prices in Seocho-gu and Gangnam-gu each rose by 0.01%, but the increase slowed compared to last week due to the rise in listings. Songpa-gu, where urgent sale listings increased around Jamsil, showed weakness for the second consecutive week with a 0.01% decline. Yongsan-gu, which had been strong due to the positive effect of the presidential office relocation, rose by 0.03% this week, but the increase was smaller than last week's 0.05%.

In particular, apartment prices in Gangbuk-gu (-0.02%), Dongdaemun-gu (-0.01%), and Dobong-gu (-0.02%) turned downward this week, and Nowon-gu continued to decline for the fourth consecutive week, highlighting the weakness in non-Gangnam areas.

The Real Estate Board analyzed, "With the property tax base date approaching and the temporary exclusion from capital gains tax surcharges, urgent sale listings have increased, and with the base interest rate hikes, buying demand has decreased, leading to an overall decline in Seoul."

Gyeonggi-do (-0.02%) and Incheon (-0.05%) also continued to show similar declines as last week.

Goyang-si (0.06%), Seongnam Bundang-gu (0.05%), and Gunpo (0.05%), which have expectations for first-generation new town reconstruction, rose relatively sharply, but Anyang-si Dongan-gu, where Pyeongchon New Town is located, fell by 0.01%, showing a temperature difference even within the first-generation new towns depending on the building age.

Outlying areas of the metropolitan area such as Siheung (-0.15%), Uiwang (-0.12%), Hwaseong (-0.09%), and Osan (-0.08%) continue to show weakness as urgent sale listings increase.

In Incheon, apartment prices in Yeonsu-gu fell by 0.18%, and all districts recorded negative changes.

Daegu (-0.18%) continued to see a decline due to inventory backlog and the impact of new housing supply.

On a nationwide basis, prices fell by 0.01% for the fourth consecutive week.

Contrary to concerns that the jeonse (long-term lease) market prices would become unstable starting in August as the contract renewal right expires and listings increase, stability has continued so far.

Jeonse prices for apartments in Seoul and Gyeonggi areas both fell by 0.01% compared to last week, and Incheon dropped by 0.07%.

The Real Estate Board analyzed, "Areas with good school districts or relocation demand due to redevelopment projects saw price increases, but overall, listings accumulated and prices declined due to the seasonal off-season and price burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)