Increase in Fuel Costs Due to Resumption of International Flights

Burden on Performance from Workforce Expansion

[Asia Economy Reporter Yoo Hyun-seok] There are forecasts that the profitability of major airlines such as Korean Air and Asiana Airlines will significantly decline. Although they posted good results this year due to increased cargo transportation volume and strong freight rates driven by expectations of economic recovery, the market sentiment has changed due to high oil prices. The increased labor costs following the resumption of international flights are also cited as a cause.

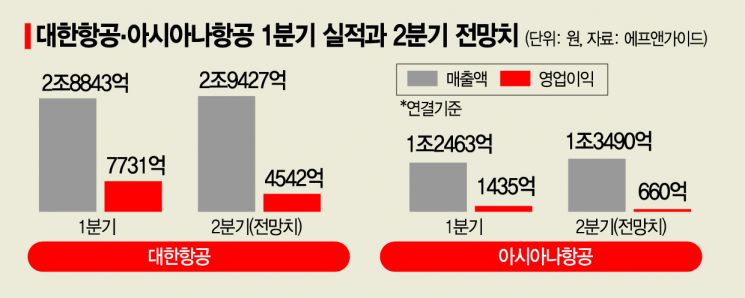

According to FnGuide on the 3rd, securities firms forecast the consolidated operating profit for the 2nd quarter of Korean Air and Asiana Airlines to be 454.2 billion KRW and 66 billion KRW, respectively. This represents an increase of approximately 135% and 18% compared to the same period last year. However, compared to the previous 1st quarter, these figures have decreased by 41% and 54%, respectively. Korean Air's operating profit in the 1st quarter of this year was 773.1 billion KRW, and Asiana Airlines recorded 143.5 billion KRW.

In particular, the industry expects that with the continued high oil prices and the resumption of international flights, fuel and labor costs will further increase. On the 1st (local time), the July West Texas Intermediate (WTI) crude oil price on the New York Mercantile Exchange rose by $0.59 to $115.26 per barrel compared to the previous trading day. Notably, since recording $94.29 per barrel on April 11, prices have consistently remained above $100 per barrel.

SK Securities forecasts that Korean Air will spend 625.2 billion KRW on fuel costs and 519.4 billion KRW on labor costs, representing increases of 57.5% and 17.3% respectively compared to the same period last year. Korea Investment & Securities expects that Asiana Airlines will spend 322 billion KRW and 149 billion KRW on fuel and labor costs respectively on a separate basis, indicating increased expenses compared to early this year.

The decision to increase personnel in preparation for the recovery of air passenger demand is also expected to have a negative impact on immediate earnings.

Until now, all airlines have received employment retention subsidies, but Korean Air stopped receiving them from March this year. Asiana Airlines will receive them only until this month. Although air passenger demand has not yet fully recovered to pre-COVID-19 levels, it is expected to recover as early as the end of this year or next year, prompting major airlines to undertake internal restructuring. An industry official said, "Compared to when cargo freight rates were at their peak, they have fallen, and the passenger sector is still struggling to generate profits. Due to high oil prices and labor costs, the profit margins of major airlines are expected to decline."

Major airlines are expected to record sales figures similar to those of the 1st quarter. Although cargo is on a downward trend, the increase in the passenger sector is expected to compensate for this. Securities firms forecast the 2nd quarter sales of Korean Air and Asiana Airlines to be 2.8843 trillion KRW and 1.349 trillion KRW, respectively.

The TAC index, a cargo freight rate index, shows that air cargo freight rates on the Hong Kong?North America route dropped from $10.90 per kg in January to $8.18 in March this year. However, in April and May, the rates rebounded to $9.57 and $9.69 respectively, successfully reversing the downward trend for the time being.

Additionally, with the easing of COVID-19 quarantine measures, the operation of international passenger flights has increased, leading to higher reservation rates. Korean Air plans to operate 182 international flights per week starting this month, an increase of 40 flights compared to 142 flights per week last month. Asiana Airlines also increased to 136 flights per week, about 15 more than a month ago. A representative from a major airline said, "It is difficult to provide exact reservation figures, but we understand that reservations this month have significantly increased compared to the previous year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.