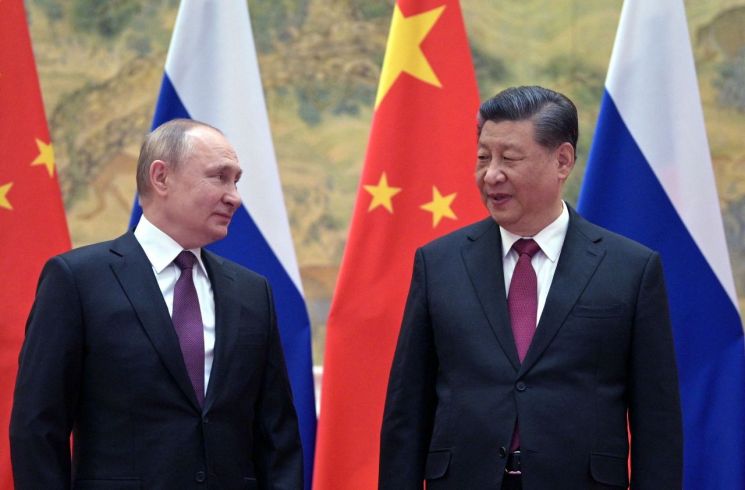

[Asia Economy Reporter Kim Hyunjung] As direct currency transactions between China and Russia rapidly increase, the transition to a global 'Multipolarity' system is gaining momentum. The unipolar system centered on the United States is breaking down, and an order centered on the US, China, and Russia is being established, analysts say.

On the 30th (local time), Bloomberg reported that the monthly currency transaction volume between China and Russia reached $4 billion (approximately 4.9612 trillion KRW), a 1067% surge compared to the previous year. The report stated, "This signals that Russians are increasingly turning to Chinese products to replace Western imports and international brands that have disappeared from store shelves," adding, "China is creating new momentum at a time when tensions with the US are escalating and the internationalization process of the yuan is slowing."

Yuri Popov, Currency and Interest Rate Strategist at Sberbank CIB, explained, "The main players in the yuan-ruble market are corporations and banks, but interest from individual investors is also growing," noting, "The trading volume in the Moscow Exchange's spot market has surged." He added, "This is due to concerns about sanctions and the intention to encourage the use of national currencies in bilateral trade between Russia and China."

According to Bloomberg's data, approximately 25.91 billion yuan (about 4.8091 trillion KRW) has been exchanged for rubles in the Moscow spot market as of May. This is nearly 12 times the level compared to February, when Russia invaded Ukraine. Steven Chiu, a strategist at Bloomberg Intelligence, predicted, "Transactions will increase further due to the globalization of the yuan," and "Russia will trade more in yuan and increase its reserves."

Meanwhile, the dollar-ruble transaction volume is at its lowest level in 10 years based on the 20-day moving average. The ruble's value has risen 118% against the US dollar between early March and the end of May.

The moves by China and Russia are also gaining traction in some emerging markets. Saudi Arabia plans to price some oil contracts in yuan, and India is exploring a rupee-ruble payment structure. According to the International Monetary Fund (IMF), as global central banks diversify their reserves, the dollar's share of holdings dropped to 59% in the fourth quarter of 2020, marking the lowest level in 25 years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.