Korea Federation of SMEs Announces June Small Business Economic Outlook Survey Results

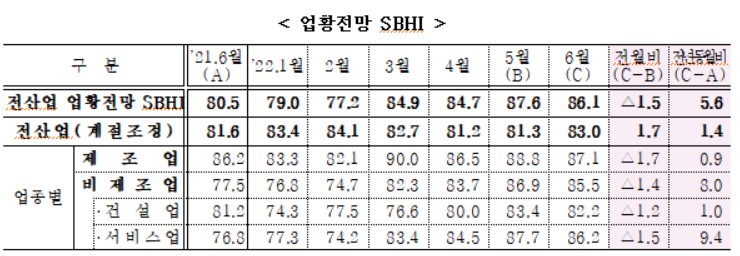

[Asia Economy Reporter Kim Bo-kyung] The Small and Medium Business Sentiment Index (SBHI) for next month was recorded at 86.1, down 1.5 points from the previous month. It is analyzed that the continued rise in international raw material prices negatively affected the sentiment of small and medium-sized enterprises (SMEs).

The Korea Federation of SMEs announced on the 30th that the 'June SME Business Outlook Survey,' conducted from the 16th to the 23rd with 3,150 SMEs, showed the business outlook index at 86.1, a decrease of 1.5 points compared to the previous month.

Although it did not continue the upward trend seen in May (87.6), which was the highest since the domestic outbreak of COVID-19, it rose 5.6 points compared to the same month last year, indicating mixed expectations and concerns about future economic conditions.

Despite the easing of social distancing measures, the recovery of consumer sentiment has been delayed, and the continued rise in international raw material prices is expected to have negatively impacted the sentiment of SMEs.

The June business outlook for manufacturing was 87.1, down 1.7 points from the previous month (up 0.9 points year-on-year), and for non-manufacturing, it was 85.5, down 1.4 points from the previous month (up 8.0 points year-on-year).

Construction (82.2) fell 1.2 points from the previous month, and services (86.2) dropped 1.5 points from the previous month.

Except for the financial condition outlook (81.7→82.5), the outlooks for domestic sales (87.6→86.9), exports (89.4→87.1), operating profit (82.4→81.2), and employment (93.3→93.6), which shows a reverse trend, are expected to worsen compared to the previous month.

The main difficulties faced by SMEs in May were domestic demand slump (54.0%) as the highest proportion, followed by rising raw material prices (51.7%), increased labor costs (43.4%), and excessive competition among companies (39.4%).

The response rates for domestic demand slump (57.6→54.0), rising labor costs (45.2→43.4), and delayed collection of sales proceeds (19.7→18.9) decreased compared to the previous month, while the response rates for exchange rate instability (12.2→15.7) and excessive competition among companies (38.8→39.4) increased compared to the previous month.

The average operating rate of small and medium manufacturing industries in April 2022 was 72.5%, rising 0.1 percentage points from the previous month and 1.4 percentage points year-on-year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.