Major Raw Material Dependence on China for Imports Absolute

Concerns Raised Over China's 'Resource Weaponization' Amid US-China Conflict

"Government Must Actively Diversify Import Sources," Experts Urge

The so-called ‘urea solution shortage crisis’ that occurred last year is a representative case that highlighted the importance of securing global supply chains. Due to trade conflicts between Australia and China, exports of urea were restricted, causing the price of urea solution?which had a 97% dependence on China?to surge more than tenfold. As a result, South Korea was hit hard. Truck lines seeking urea solution formed at gas stations nationwide. The government hurriedly mobilized military transport planes to secure alternative supply routes to prevent the paralysis of the logistics system caused by the urea solution shortage. This was a harsh lesson for relying on a single country for essential industrial items.

Concerns about a ‘second urea solution crisis’ due to South Korea’s excessive import dependence on China are closely related to the worsening global supply chain crisis caused by the Russia-Ukraine conflict and the prolonged lockdown measures in Shanghai, China. Among key goods imported to South Korea from the U.S., China, and Japan, 75% are Chinese-made. Particularly, items with vulnerable supply chain stability account for an absolute 95.4% share.

According to a report released on the 30th by the Federation of Korean Industries, 75.5% of key imported items traded with the U.S., China, and Japan are Chinese-made. Among 228 items with over 90% import dependence, a staggering 172 are from China.

The dependence on China for tungsten oxide, used in semiconductors and high-strength steel, is close to 95%, and magnesium ingots essential for automobile production are entirely imported from China. If China imposes export restrictions again due to trade disputes with other countries, as it did during the ‘urea solution crisis,’ domestic industries will inevitably suffer significant damage.

In particular, with the recent launch of the Indo-Pacific Economic Framework (IPEF) led by the U.S., concerns have arisen that China could weaponize resources at any time. If economic and diplomatic cooperation with China is not closely maintained through this framework, a ‘second urea solution crisis’ could once again strike the South Korean economy. A business community official said, "Because dependence on China is so high, the global supply chain crisis is expected to continue. There is concern that China, displeased with IPEF participation, might weaponize resources."

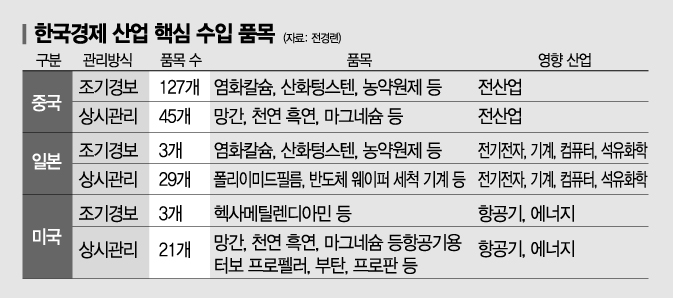

Experts recommend that the government make policy efforts to resolve this China-centric situation. Professor Choi Nam-seok of Jeonbuk National University identified 133 imported items vulnerable to global supply chain shocks, including tungsten oxide, manganese, and magnesium, in his report. Among these, 127 items are Chinese-made, representing almost the entire group. Japanese and American items accounted for only three each. Professor Choi pointed out, "An early warning management system for key imported items should be established, and government response plans should be continuously adjusted in a customized manner based on field demand."

Yoo Hwan-ik, head of the industrial division at the Federation of Korean Industries, also stated, "As the global supply chain crisis worsens, measures should be devised to resolve the China concentration of key imported items through diversification of import sources and active participation in global supply chain alliances."

Meanwhile, with the inauguration of the new government, the need for economic cooperation with Japan is also emerging. Since trade between the two countries decreased by about 10% due to Japan’s export restrictions on materials, parts, and equipment (so-called ‘Sobu-jang’ items) to South Korea, it is pointed out that both countries should strengthen economic cooperation to reinforce the global supply chain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.