[Asia Economy Reporter Ji Yeon-jin] "The most certain prospect for the future unfolding in 5 years is the expansion of electric vehicles."

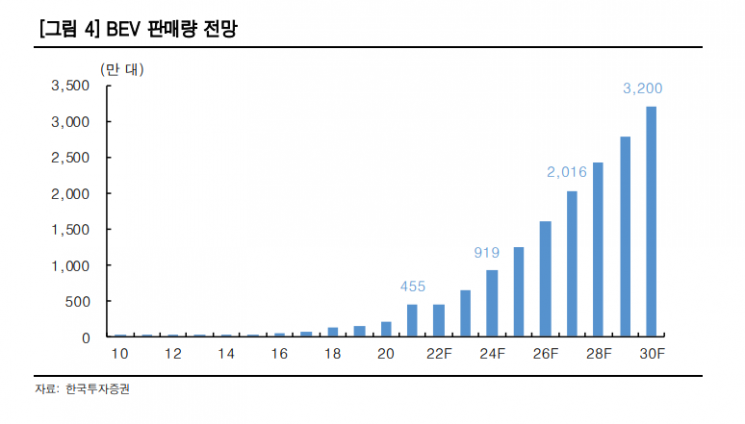

Recently, as international oil prices soar, global sales of electric vehicles are increasing, leading to a surge in electricity demand. With the acceleration of renewable energy generation, the wire and electrical equipment sectors are gaining attention.

Choi Moon-sun, a researcher at Korea Investment & Securities, stated in a report published on the 30th, "The common denominator of the expansion of battery electric vehicles and renewable energy is investment in transmission and distribution networks," adding, "Companies producing wires and electrical equipment, which are core products of transmission and distribution networks, will benefit."

In the recent stock market, as the transition to electric vehicles intensifies, investments are pouring into various stocks producing complete electric vehicles, motors, batteries, battery materials, and battery components. However, since the COVID-19 pandemic triggered a concentration of investments in technology stocks, interest in wire and electrical equipment companies remains low.

As electric vehicle driving increases, more electricity is needed accordingly, requiring the expansion of power generation and transmission and distribution. Also, as renewable energy generation increases, new transmission and distribution infrastructure must be established. Therefore, the common denominator of electric vehicles and renewable energy is transmission and distribution, and the core components of this are wires and electrical equipment.

Researcher Choi explained, "Generally, the expansion and new construction of transmission and distribution infrastructure proceed over the mid to long term, so related investments should also be executed from a mid to long-term perspective." However, "Currently, the environment is suitable for short-term investments in wire and electrical equipment companies. These companies have low labor costs and, supported by demand, can easily pass costs onto prices, so profitability damage due to inflation is limited."

According to an analysis by Korea Investment & Securities of the performance and order backlog of domestic wire and electrical equipment companies, these companies already turned profitable last year and are expected to enter a full-fledged upward cycle starting this year.

Researcher Choi presented LS as the top pick with a target price of 115,000 KRW, indicating a 95% upside potential from the current price. He also gave a buy recommendation and a target price of 8,200 KRW for Iljin Electric.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.