[Asia Economy Reporter Hwang Yoon-joo] An analysis has emerged that the price decline will also be delayed as the expansion of polysilicon production in China is postponed.

On the 29th, according to KB Securities, researcher Kang Hyo-joo stated, "The expansion volume in the first half of the year is only 100,000 tons from Tongwei (original plan was 160,000 tons). It appears that Chinese polysilicon companies' expansions are delayed compared to the original plans."

Looking at the first-quarter earnings announcements of Chinese polysilicon companies, the 160,000 tons of expansion volume postponed last year (100,000 tons from Tongwei, 60,000 tons from GCL) was expected to be fully released in the first half of this year. However, researcher Kang diagnosed that among them, only Tongwei is currently in mass production.

Researcher Kang explained, "The expansion volume scheduled for release in the third quarter (50,000 tons from Tongwei, 34,000 tons from Xinte) has also been postponed to the end of the year. Tongwei was supposed to start operating an additional 50,000-ton (Baotou Phase 1) factory from June this year, but the schedule has been pushed back to the fourth quarter."

In the case of Xinte, they planned to renovate their 66,000-ton factory located in Xinjiang to expand the mass production scale to 100,000 tons.

Researcher Kang pointed out, "They expected to complete the renovation work in the second quarter and begin full-scale mass production in the third quarter. However, since there has been no update on the progress of the factory renovation until the end of May, it is necessary to check in June whether mass production in the third quarter is possible."

He added, "From a very conservative perspective, assuming that the mass production schedules of GCL's Lushan Phase 1 60,000 tons (some mass production has started but assumed as '0'), Tongwei Baotou Phase 1 50,000 tons (confirmed postponed), and Xinte Xinjiang factory renovation for 34,000 tons (need to check completion in June but assumed postponed) are all delayed to the fourth quarter, the additional supply volume until the third quarter this year will be only 100,000 tons."

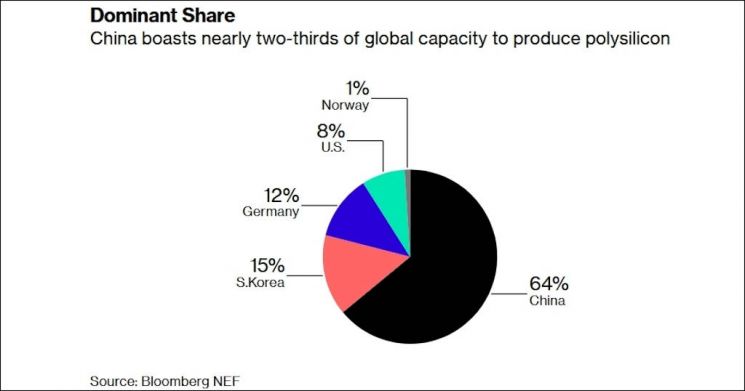

Based on the 2022 global solar new installation forecast of 230GW, the polysilicon demand for this year is estimated to be about 730,000 tons. Reflecting the postponed polysilicon expansion plans, the total global polysilicon supply is estimated to be 720,000 tons in the third quarter.

Researcher Kang concluded, "The timing of the demand-supply balance, which was expected in the second quarter according to the original plan, has been delayed by one quarter. Although a price decline in polysilicon was expected from the end of the second quarter, the postponement of expansion makes it highly likely that the full-scale price decline phase will also be delayed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.