Stock Price Drops Over 37% This Year

Gaming Sales Slump Due to China's 2nd Quarter Lockdowns

Performance Expected to Improve in Second Half with New Product Launches Driving Replacement Demand

NVIDIA Volta

NVIDIA Volta

[Asia Economy Reporter Minji Lee] NVIDIA, which has shown sluggish stock performance this year due to concerns over earnings, is expected to seek a rebound in the second half of the year supported by new product launches.

On the 29th, NVIDIA's stock price stood at 188.11. Since the beginning of the year, the stock price has fallen by about 37.5%. This decline is estimated to be due to external environmental uncertainties and weak gaming demand in the second quarter.

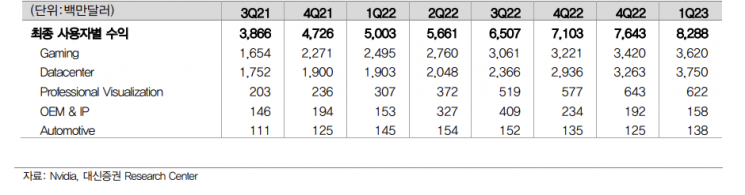

NVIDIA recorded revenue of $8.3 billion in the first quarter (February to April), a 46.4% increase compared to the same period last year. Earnings per share were $1.36, up 48.6%, exceeding market expectations by 2% and 4.7%, respectively. Despite concerns over slowing GPU demand, the gaming segment grew 31.2% to $3.6 billion. The number of laptop models equipped with the RTX 30 series increased to over 180, and the impact related to cryptocurrency mining was better than expected due to mining restriction measures.

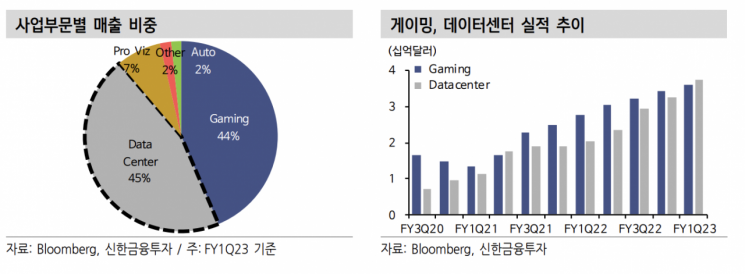

The data center segment saw revenue double compared to the previous year, reaching $3.8 billion, an 82.9% increase, accounting for 45% of total revenue. Professional visualization grew 67% to $620 million. The automotive and robotics segment declined 10% to $140 million during the same period. Operating margin improved by 1.1 percentage points year-over-year to 46.3%.

NVIDIA's revenue guidance for the second quarter is approximately $8.1 billion, below the market consensus of $8.5 billion. The guidance was lowered by $500 million due to external factors. Researcher from Mirae Asset Daewoo Securities explained, “Gaming revenue is expected to decrease by $400 million due to supply disruptions caused by China's lockdown and $100 million decline in data center revenue from Russia due to the war,” adding, “The company has ceased transactions with Russia, which accounts for about 2% of total revenue.” Gross margin is projected to remain at 67.1%, the same as in the first quarter.

However, performance improvement is expected in the second half of the year with new product launches. Products across various fields including artificial intelligence and virtual reality are anticipated. The gaming segment is expected to regain momentum starting with the launch of the RTX 40 series in the second half. Hyungtae Kim, a researcher at Shinhan Financial Investment, said, “Among the company's GPU-equipped systems, 30% use the RTX series, and considering the launch timing of the previous GTX series, over 70% of systems are expected to have replacement demand,” adding, “Inventory stabilization in the second half, lower distribution prices, and strengthened promotions will stimulate purchasing demand.”

The automotive segment, expected to show high growth, has signed contracts with Lucid Motors and BYD, with approximately $11 billion expected to be recognized over six years. The backlog from last year is about $8 billion.

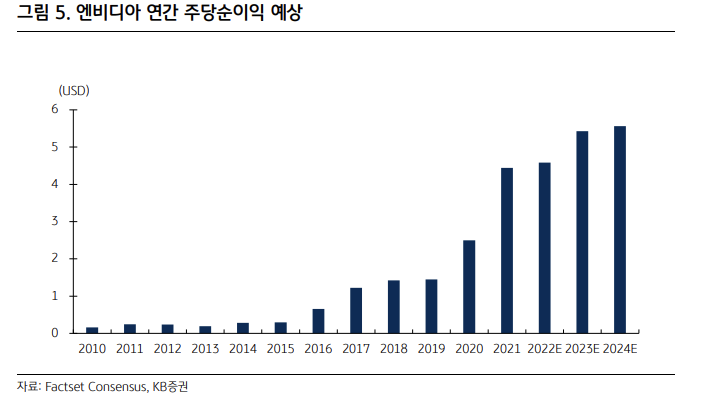

Meanwhile, in the first quarter, NVIDIA decided to execute a $2 billion share repurchase and pay $100 million in dividends. The board approved expanding the share repurchase program to a total of $15 billion through 2023. KB Securities researcher Joongho Yoo analyzed, “This is supported by margin improvement from software business growth and an upward trend in free cash flow,” adding, “Annual free cash flow is expected to grow 48% year-over-year to $12.1 billion this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.