First Decline Since Statistics Compilation in 1Q

Growth Resumed from 2Q but Increase Remains Modest

Bank NIM Rises but Long-Term Soundness and Growth Face Challenges

[Asia Economy Reporter Minwoo Lee] Household loans in the first quarter of this year decreased for the first time since the household credit statistics began. This has led to forecasts that the justification for interest rate hikes will be strengthened due to the slowdown in household debt.

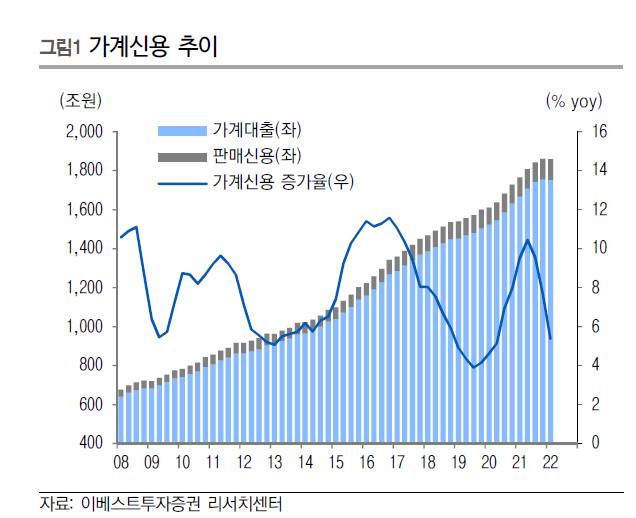

On the 28th, Ebest Investment & Securities made this assessment. According to the "Household Credit (Provisional) for Q1 2022" announced by the Bank of Korea on the 24th, the balance of household credit (household loans + sales credit) and household loans at the end of the first quarter of this year were recorded at 1,859.4 trillion KRW and 1,752.7 trillion KRW, respectively. These amounts represent decreases of 600 billion KRW and 1.5 trillion KRW compared to the previous quarter. This is the first time since Q1 2013 that the household credit balance has decreased. It is also the first time household loans have decreased since the household credit statistics began.

This is interpreted as the simultaneous suppression of household loan supply and demand due to strengthened loan regulations by financial authorities, sluggish asset markets, and seasonal characteristics. The household credit growth rate slowed to 5.% year-on-year, showing a contrast to the over 10% growth seen in Q2 last year.

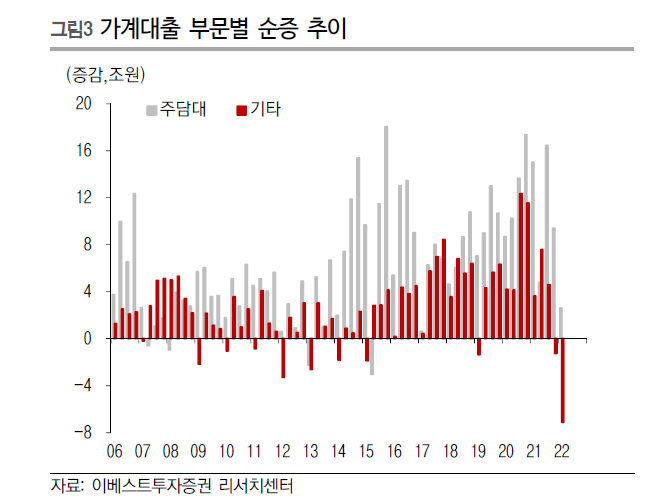

By sector, mortgage loans within household loans increased by 8.1 trillion KRW compared to the previous quarter, mainly due to jeonse loans. This is the smallest increase in two years and three months since Q4 2019. It is about 36% less than the previous quarter's increase of 12.7 trillion KRW. Additionally, other loans (credit loans) decreased by 9.6 trillion KRW due to strengthened regulations, pulling down the total household loans.

Researcher Baeseung Jeon of Ebest Investment & Securities explained, "Typically, in the first quarter, inflows from holidays, previous year’s performance, and bonuses occur, but combined with decreased real estate transactions and a sluggish stock market, credit loans significantly decrease."

Furthermore, due to strengthened loan regulations mainly in the banking sector, household loans from deposit banks and non-bank deposit-taking institutions (such as mutual savings banks and credit unions) decreased by 4.5 trillion KRW and 2.5 trillion KRW respectively compared to Q4 last year. On the other hand, other financial institutions such as insurance companies and securities firms increased by 5.5 trillion KRW.

Meanwhile, the balance of sales credit increased by 800 billion KRW from the end of the previous quarter to 106.7 trillion KRW, mainly led by credit card companies and specialized credit finance companies. However, the increase was significantly smaller than the 5.2 trillion KRW increase in Q4 last year.

Although household loans turned to an increasing trend in April, the increase is expected to be modest. Banks are offering preferential interest rates to boost business, but the high interest rate levels combined with a sluggish housing market and deteriorating stock market conditions are factors limiting growth.

As the household credit growth rate enters the 5% range, the justification for interest rate hikes is expected to grow stronger. Researcher Jeon analyzed, "This could again burden the asset market, making it difficult for household loan growth to expand significantly in the future. While the current phase of rising net interest margins may have little impact on performance, potential economic slowdown could pose challenges to growth and soundness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.