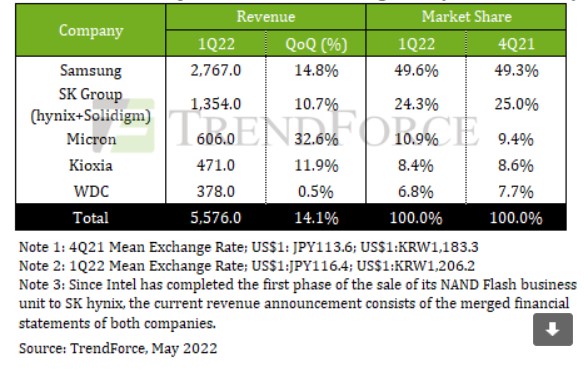

[Asia Economy Reporter Park Sun-mi] Due to the expansion of data centers in the North American region, sales of enterprise SSDs required for data center servers in the first quarter of this year increased by 14.1% compared to the previous quarter, reaching $5.58 billion.

According to Taiwanese market research firm TrendForce on the 27th, Samsung Electronics, the industry leader, recorded sales of $2.767 billion, up 14.8%, capturing a market share of 49.6%. This market share is 0.3 percentage points higher than the 49.3% recorded in the fourth quarter of last year.

In second place is SK Hynix, which is creating synergy with Solidigm. SK Hynix's enterprise SSD sales increased by 10.7% to $1.354 billion. Its market share stands at 24.3%.

The enterprise SSD market held by the top two companies, Samsung Electronics and SK Hynix, accounts for 80%. The remainder is divided among third-place Micron (market share 10.9%), Kioxia (8.4%), and WDC (6.8%).

Demand for enterprise SSDs used in data center servers remains steady, and the price increase of enterprise SSDs, caused by production disruptions due to a raw material contamination incident at Kioxia's production facility, led to overall sales growth. TrendForce explained, "Since the COVID-19 pandemic, the expansion of non-face-to-face services has led global IT companies to expand data centers, resulting in an increase in related capital investments."

Meanwhile, global NAND flash sales in the first quarter of this year recorded $17.92 billion, a 3% decrease from the previous quarter. Samsung Electronics, ranked first, saw sales increase by 3.4% to $6.32 billion, while SK Hynix, ranked third, recorded a 10.7% decrease to $3.225 billion. The decline in SK Hynix's NAND flash sales is analyzed to be due to the sluggish smartphone demand in China, which affected the NAND shipments of SK Hynix, whose main product is mobile devices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.