Spent 1.4 Trillion Won More in Q1 Than Last Year

LG Energy Solution Up 21% in Separators, etc.

Samsung SDI Invests 1.2 Trillion in Electrode Materials

SK On's Purchase Costs Increase 87%

Musk: "Lithium Prices Are Crazy"

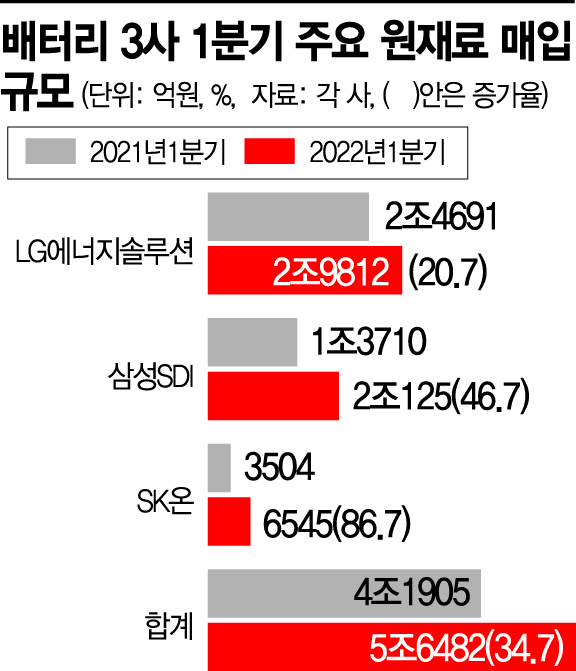

[Asia Economy Reporter Oh Hyung-gil] It has been revealed that the three domestic electric vehicle battery companies spent 1.4 trillion KRW more on raw material purchases in the first quarter compared to last year.

This increase is partly due to the full-scale operation of major production facilities this year, leading to higher material purchases, but it is also largely attributed to the recent sharp rise in key raw material prices. As demand for electric vehicles surges rapidly, warnings about supply instability of battery materials are also emerging.

According to the industry on the 27th, LG Energy Solution, Samsung SDI, and SK On spent 5.64 trillion KRW on major raw material purchases in the first quarter, a 35% increase from 4.19 trillion KRW in the same period last year.

LG Energy Solution spent 2.98 trillion KRW on purchasing battery raw materials such as cathode materials, anode materials, and separators, marking a 21% increase compared to the same period last year. During the same period, battery production performance increased from 5.4 trillion KRW to 6.4 trillion KRW. The growth rate was 18%, and the remaining increase is analyzed to be influenced by the rise in raw material prices. LG Energy Solution explained that the price of cathode materials for small applications in the first quarter was $33.99 per kg, up 56% from $21.81 last year.

Samsung SDI also spent 2 trillion KRW on raw material purchases, a 46.7% increase from last year. They spent 1.2 trillion KRW on electrode materials, and 500 billion KRW and 300 billion KRW on assembly and pack materials, respectively.

Samsung SDI's small battery production volume in the first quarter was 525 million units, a 22% increase from 430 million units in the same period last year. Additionally, the price of cathode active materials, a key raw material, rose 24% from $26.36 per kg to $32.80 per kg, driving up material purchase costs.

SK On's raw material purchase cost surged 87% to 654.5 billion KRW compared to the same period last year. The operation of the Hungary Plant 2 and the Georgia Plant 1 in the U.S. started in the first quarter of this year, increasing material demand, and the price of cathode materials soared 64% from 28,000 KRW per kg last year to 46,000 KRW per kg.

On the 17th, visitors are examining Samsung SDI's EV battery pack at 'InterBattery 2022' held at COEX, Samseong-dong, Gangnam-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

On the 17th, visitors are examining Samsung SDI's EV battery pack at 'InterBattery 2022' held at COEX, Samseong-dong, Gangnam-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

The price of cathode materials is important as they are estimated to account for 40-42% of the cost of electric vehicle batteries. The battery industry explains that the surge in demand for electric vehicle batteries combined with the Russia-Ukraine war has caused a sharp rise in the prices of key minerals used as raw materials for cathode materials.

According to the Korea Resource Information Service, the price of nickel rose from $17,000 per ton in January last year to over $20,000 in January this year, even spiking to $40,000 during the Russia-Ukraine conflict. Lithium prices were about 10,000 KRW per kg last year but surged to about 50,000 to 60,000 KRW in January this year.

Battery companies explain that as battery mass production scales increase, raw material purchase costs will inevitably rise, and they link the prices of key raw materials to product prices. They also minimize price increase factors by signing long-term supply contracts with trading partners, but supply instability due to rising raw material prices is also growing.

Electric vehicle manufacturers are also concerned about battery material shortages. Carlos Tavares, CEO of Stellantis, recently warned, "There will be a shortage of electric vehicle batteries until 2025 and raw materials until 2027-2028."

Elon Musk, CEO of Tesla, also said in April that lithium prices have risen too much and that Tesla might have to enter related businesses. Musk pointed out on Twitter, "Lithium prices have gone crazy. It's not that lithium itself is scarce. Lithium is found almost everywhere on Earth. However, the speed of mining and refining is slow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)