A luxury brand 'Chanel' is set to raise prices in the United States next month, leading to a queue forming in front of the luxury goods section at a major department store in Seoul. Photo by Jinhyung Kang aymsdream@

A luxury brand 'Chanel' is set to raise prices in the United States next month, leading to a queue forming in front of the luxury goods section at a major department store in Seoul. Photo by Jinhyung Kang aymsdream@

[Asia Economy Reporter Ji Yeon-jin] The domestic luxury market recorded a growth rate of nearly 30% last year. This is interpreted as the MZ generation, a young demographic whose overseas travel was restricted during the COVID-19 pandemic, emerging as the main consumer group, resulting in a growth rate far exceeding that of the global luxury market.

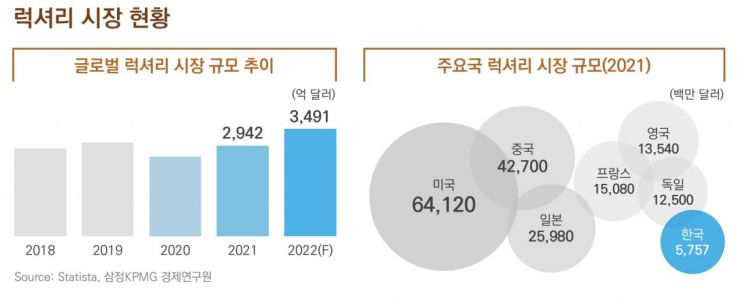

According to the report "New Luxury Business Trends Leading the Luxury Market" published on the 25th by Samjeong KPMG (Chairman Kim Gyo-tae), the global luxury market size reached $294.2 billion (approximately 374 trillion KRW) last year, growing 13.5% compared to the previous year, showing a V-shaped rebound to pre-pandemic levels. During this period, the domestic luxury market was $5.8 billion, recording a growth rate of 29.6% compared to the previous year. The report forecasts that it will exceed $7 billion in 2024.

Looking at the luxury market size of major global countries, as of 2021, the United States forms the largest market at $64.1 billion. China ($42.7 billion), Japan ($26 billion), France ($15.1 billion), and the United Kingdom ($13.5 billion) followed, with South Korea ($5.8 billion) ranking 10th.

Last year, the sales growth rate of overseas famous brands at major domestic department stores was 37.9%, and for all items, it was 24.1%, clearly showing domestic consumers' preference for overseas luxury brands. Samjeong KPMG analyzed this as a result of luxury purchase demand concentrating on department stores due to continued travel restrictions and a pronounced tendency for revenge spending.

The report presents the 'New Luxury' business trends as ▲Expansion of luxury consumer base among the MZ generation ▲Intensified competition among online platforms ▲Revitalization of the retail market ▲Rise of digital luxury.

As the MZ generation establishes itself as a new luxury consumer base, contemporary brands are emerging as new luxury brands threatening classic luxury brands represented by Erusha (Herm?s, Louis Vuitton, Chanel). Additionally, the luxury sector is expanding across lifestyles, with luxury brand companies diversifying categories into kids, pets, living, and opening restaurants and cafes.

In 2021, online channels accounted for 22% of the global luxury market, the second-highest share after brand shops. The online luxury market was led by luxury platforms such as Farfetch and Mytheresa, but recently, e-commerce companies like Amazon and Alibaba, as well as luxury brand companies, have entered the market, expanding the number of players.

With a consumer tendency to value experience over ownership, attention is focused on the luxury resale market. The secondhand luxury market is developing mainly through online platforms, and luxury brand companies are actively entering the resale market. Gucci and Burberry have partnered with the secondhand luxury platform The RealReal to supply their products to the platform.

Luxury brand companies are entering the digital market to secure Generation Z as future consumers. Luxury brands such as Gucci and Balenciaga are developing three types of digital luxury using NFT, AR, VR, and 3D: metafashion, digital runway, and digital artwork. The report cites exclusivity, scarcity, and growth potential as the background for the expansion of digital luxury, stating that the market environment surrounding luxury brand companies is rapidly changing with technological advancements.

Meanwhile, as the luxury market continues to grow, the luxury sector is emerging as a new investment destination. Global investors such as private equity and venture capital have been making large-scale investments in luxury brand companies with high brand value, such as Breitling, Blue Nile, and Tiffany, since 2017.

Recently, there has been particular attention on online luxury platform companies. European-based luxury resale platform Vestiaire Collective, luxury watch resale platform WatchBox, and several other online luxury platforms have attracted hundreds of millions of dollars in investment. Additionally, major luxury platforms such as Farfetch, The RealReal, and Mytheresa have succeeded in initial public offerings (IPOs), securing investment funds and focusing on expanding their service areas.

Kim Yumi, Executive Director of the Financial Advisory Division at Samjeong KPMG, said, "Domestic luxury-related companies must monitor market trends and seize business opportunities in response to the rapidly changing luxury market environment. They should pursue an online-offline dual approach strategy that maximizes offline customer experience for luxury consumers while enhancing online accessibility. As the luxury resale market expands, efforts should also be made to develop resale business models that can create synergy with their own business."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.