War-Induced Supply Chain Crisis Realized ⑤ Energy & Logistics

Petrochemical & Logistics Beneficiaries

Profit Erosion Concerns Amid Prolonged High Oil Prices

US, China, Russia Energy Supply Chain Conflict

Corporate Logistics & Production Cost Burdens

Potential Long-Term Fixed Risk, Not Just Short-Term

[Asia Economy Reporters Hyunseok Yoo and Donghoon Jung] As the global supply chain crisis continues, some companies have emerged as beneficiaries. These include heavy chemical industries such as petroleum and chemicals, as well as logistics sectors like aviation and shipping. However, they are not entirely in a position to celebrate. With rising oil prices, they now face concerns over profit erosion.

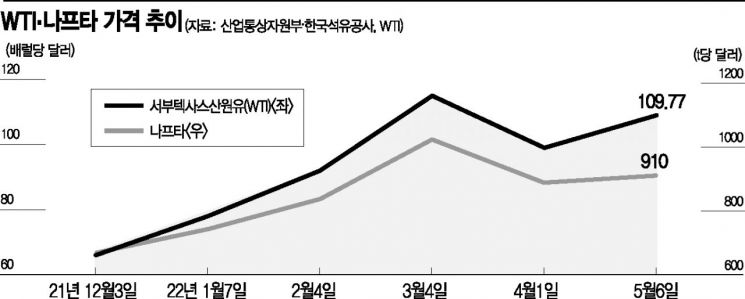

According to the Ministry of Trade, Industry and Energy and the Korea National Oil Corporation on the 24th, the price of West Texas Intermediate (WTI) crude oil reached $109.7 per barrel (approximately 138,000 KRW), marking an increase of about 65.5% from $66.2 per barrel (approximately 83,300 KRW) just five months ago in December. Last December, the price of naphtha rose from $669.5 per ton (approximately 843,200 KRW) to $910 per ton (approximately 1,146,100 KRW), an increase of 35.9%.

◆ Thought to be the biggest beneficiary, but now high oil prices are a burden = The petrochemical industry, which was expected to benefit the most from high oil prices, is increasingly concerned. After recording record-high earnings last year, the industry now faces multiple challenges such as soaring raw material costs and declining demand. There are bleak forecasts that poor performance may continue into the second half of the year.

In fact, the price of naphtha extracted from crude oil has been volatile after reaching an all-time high. Naphtha serves as a basic raw material for plastics, textiles, rubber, and other materials, and products made from naphtha are used in almost all consumer goods, making it the starting point of the petrochemical business. About 20% of the naphtha used by domestic petrochemical companies is imported, with approximately 23% of that coming from Russia. Due to restrictions on Russian naphtha imports, prices have surged, directly increasing the cost burden on the petrochemical industry. In fact, the operating profits of major petrochemical companies in the first quarter decreased by about 20-80% compared to last year.

An industry insider said, "The war between Russia and Ukraine has caused naphtha price increases and supply instability, which negatively affects the domestic industry. If the operating rates of European petrochemical facilities decline due to raw material procurement disruptions, the supply volume in the market will decrease, allowing domestic companies to gain some indirect benefits. However, as the global economy contracts, demand for petrochemicals itself is decreasing."

Logistics companies, including aviation and shipping, are still considered beneficiaries of the supply chain crisis. The surge in cargo volume due to COVID-19 improved market conditions. Leading Korean companies such as HMM, Korean Air, and Hyundai Glovis all recorded record or surprise earnings in the first quarter, achieving strong results.

An aviation industry official said, "Cargo transport contracts are mostly long-term, such as annual agreements. Even now, under conditions similar to the first quarter, it is difficult to secure cargo space without paying a large amount."

However, looking inside these companies, the situation is not entirely positive. Due to high oil prices caused by the supply chain crisis, companies' expenses for fuel and transportation have noticeably increased, raising cost burdens. For Korean Air, fuel costs rose from 325 billion KRW in the first quarter last year to 660 billion KRW this year, nearly doubling. During the same period, HMM's fuel costs jumped from 208 billion KRW to 332.9 billion KRW. Hyundai Glovis also saw transportation and vessel operation costs surge from 769.3 billion KRW and 283.2 billion KRW to 2.02 trillion KRW and 388.9 billion KRW, respectively.

◆ Supply chain restructuring... continuous all-round pressure on the industry = The problem is that during the global supply chain restructuring process, the cycle of supply chain disruptions is becoming more frequent and the scope of uncertainty is expanding.

With the launch of frameworks such as the Indo-Pacific Economic Framework (IPEF) led by the United States, the Regional Comprehensive Economic Partnership (RCEP) led by China, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) involving Japan and others, competition among major countries to dominate regional trade norms is intensifying.

As exclusive supply chain restructuring continues, the energy supply chain war between Russia, China, and the United States is seen as a "foretold future." High energy prices are increasingly likely to be recognized not as a short-term trend but as a fixed risk for companies. The entire industrial sector, including semiconductors, home appliances, and automobiles, is under all-round pressure as logistics and production costs rise.

Especially since the supply chain war is expected to continue, proposals for cooperation with various countries are emerging. Professor Tae-yoon Sung of Yonsei University's Department of Economics stated, "The restructuring of supply chains between the U.S. and China is causing widespread damage to the industry. From Korea's perspective, in a situation where security issues are emphasized in the global trade network, building a strong cooperative relationship with the United States is very important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.