[Asia Economy Reporter Song Hwajeong] The market environment surrounding the domestic venture ecosystem has improved approximately fivefold compared to 2008.

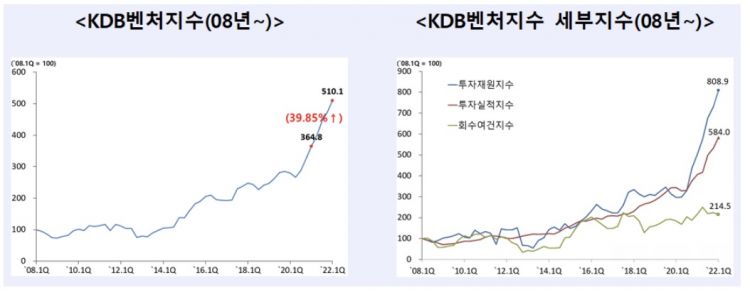

On the 24th, the Korea Development Bank (KDB) announced that the KDB Venture Index for the first quarter of this year rose 39.85% to 510.1 compared to 364.8 in the same period last year. The KDB Venture Index, developed by the Korea Development Bank in 2018 to comprehensively monitor the domestic venture ecosystem, is the first comprehensive indicator in Korea that evaluates the overall vitality of the venture ecosystem. The conditions of the venture ecosystem in the first quarter of this year have improved about five times compared to the base year 2008 (index = 100).

Looking at the detailed indices, the Investment Resources Index rose about 60.56% year-on-year to 808.9, driving the overall increase in the venture index. In particular, the cumulative amount of newly formed investment funds in the first quarter reached 2.5668 trillion KRW, increasing by 990.5 billion KRW mainly from private sector contributions compared to the same period last year when fund formation was somewhat sluggish due to the COVID-19 pandemic. This set a record high for the first quarter formation scale, influencing the index rise.

The Investment Performance Index rose about 43.68% year-on-year to 584.0. The Investment Performance Index is a lagging indicator of the Investment Resources Index and has continued its upward trend recently. The cumulative amount of new investments in the first quarter was 2.0827 trillion KRW, a 67.2% increase compared to the same period last year.

On the other hand, the Recovery Conditions Index (calculated based on the number of new KOSDAQ-listed companies and the market capitalization at the time of listing) fell 1.64% year-on-year to 214.5. It appears that the recovery through IPOs of venture companies on KOSDAQ temporarily contracted, but considering that the Recovery Conditions Index is a lagging indicator of the Investment Resources Index and the Investment Performance Index, a gradual increase is expected to continue thereafter.

An official from the Korea Development Bank said, "The KDB Venture Index has shown a steep growth trend over the past two years and continued to rise in the first quarter of this year. As the attractiveness of venture investment increases and private capital is actively flowing in, the upward trend of the index is expected to be maintained for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)