Both Countries Reaffirm 'Industrial Alliance'

Investment Expansion Amid COVID-19 Uncertainty Resolution

Clear Uptrend in Secondary Battery Stocks

Battery Cell Companies Raise Production Capacity

Battery Equipment Stocks Enter Supercycle

[Asia Economy Reporters Kwon Jae-hee and Lee Myung-hwan] As the Korea-US summit concluded reaffirming the 'industrial alliance,' attention is focusing on batteries, one of the three core industries. Battery cell companies, which had taken a conservative strategy until now, are increasing investments as uncertainties caused by COVID-19 are resolved. Along with the event of the Korea-US summit, interest has expanded not only in battery cells but also in equipment, leading to an analysis that a supercycle has arrived.

According to the Korea Exchange on the 24th, secondary battery-related stocks have collectively recorded an upward trend from the 2nd to the 23rd of this month. Despite the overall market downturn, secondary battery-related stocks such as L&F (26.13%), EcoPro BM (5.73%), LG Energy Solution (5.04%), and SK Innovation (1.95%) showed notable gains. Especially during the period from the 20th to the 23rd, which directly reflected the effect of the Korea-US summit event, L&F (2.79%), EcoPro BM (4.55%), LG Energy Solution (5.42%), and SK Innovation (2.45%) demonstrated clear upward momentum.

With the Korea-US summit acting as a catalyst, battery cell companies have continued to announce investment plans, leading battery equipment stocks to enter a supercycle (period of booming prosperity). It is expected that from 2022 to 2025, equipment orders will pour in due to the upward adjustment of production capacity by battery cell companies. The transition to a COVID-19 endemic phase and the resolution of litigation issues between the two major battery cell companies have strengthened expectations that equipment orders will follow. Until now, battery cell companies had adopted a strategy of increasing utilization rates rather than aggressive new investments due to uncertainties caused by COVID-19, and conservative investment policies had continued amid the battery litigation between LG and SK.

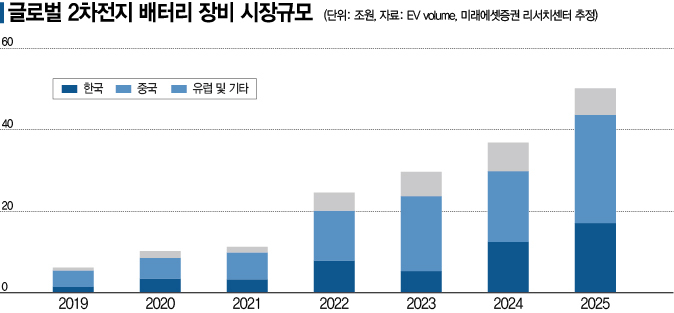

In fact, the order backlogs of the three domestic battery cell companies have been steadily increasing, and the order backlogs of equipment companies are also rising. LG Energy Solution's order backlog for the first quarter of this year is estimated to exceed 300 trillion won, and the company has announced an upward revision of its production capacity target from 440 GWh to 520 GWh by 2025. As the production capacity of battery cell companies in the upstream industry is adjusted upward, the volume of equipment orders is also increasing. The combined order backlog of major equipment companies (13 companies including CIS and PNT) has increased by 118% compared to last year, reaching 2.7 trillion won. Representative battery equipment companies include PNT, CIS, Hana Technology, Cowintech, and Wooshiread. According to EV Volume, a global electric vehicle sales data company, the battery equipment market size is expected to grow at an average annual rate of 44% from 2021 to 2025, reaching 51 trillion won by 2025.

Moreover, with the recent announcement by the U.S. Department of Commerce of an export control list including 33 Chinese companies, Korean companies are expected to benefit.

Baek Young-chan, a researcher at KB Securities, said, "The expansion of battery investment in the U.S. is expected to lead to an increase in the corporate value of K-battery," adding, "It is an important point that through this supply chain cooperation enhancement, a competitive advantage over Chinese battery companies will be secured in the U.S. electric vehicle market." He also evaluated, "Along with semiconductors, electric vehicle batteries will also increasingly require securing supply chains through local factories in the U.S., which is positive in terms of securing a long-term growth market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)