Price Fatigue and Loan Regulations Impact

Yeonsugu Down 0.7% This Year

‘Cheongra City Effect’ Also Lowers Seogu by 0.2%

[Asia Economy Reporter Ryu Tae-min] The real estate markets in Songdo New City and Cheongna International City, known as the "Gangnam of Incheon," have continued to decline throughout the first half of the year. Unlike last year when housing prices soared uncontrollably, the overall apartment market in Incheon appears to be experiencing weakened buying demand due to price fatigue, strengthened loan regulations, and interest rate hikes.

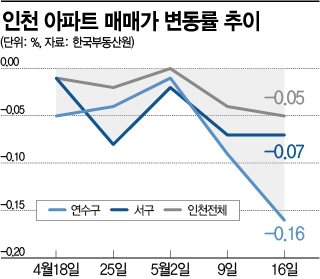

According to the weekly apartment price trends released by the Korea Real Estate Board on the 24th, the apartment sale price growth rate in Incheon for the third week of this month (as of the 16th) fell by 0.05%, a larger decline compared to the previous week (-0.04%). This marks the largest drop in 2 years and 9 months since the first week of August 2019. In Incheon, prices have been falling or stagnating for 16 consecutive weeks since the fifth week of January (as of the 31st), resulting in a total decline of 0.33%.

By region, the decline has widened in Yeonsu-gu and Seo-gu, which had maintained rapid price increases until recently. Yeonsu-gu, home to Songdo International City, recorded the highest increase in Incheon last year at 28.69%. However, since turning to a downward trend in the fourth week of January, it plummeted to -0.16% by the third week of May. Yeonsu-gu has fallen a total of 0.70% this year. Seo-gu, which greatly benefited from the Cheongna International City effect, also dropped to -0.07% in the third week of May, recording a cumulative change rate of -0.20% for the year.

According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, an 84.65㎡ (exclusive area) unit in Songdo SK View, Songdo-dong, Yeonsu-gu, was sold for 840 million KRW on the 15th of last month. Compared to 1 billion KRW in December last year, the price has dropped by 160 million KRW in five months. This trend is also seen in Cheongna International City. A unit of 84.94㎡ in Cheongna 29 Block Hoban Verdiium was traded for 695 million KRW on the 28th of last month, down 175 million KRW from the 870 million KRW price for the same size in November last year.

Buying Sentiment Freezes, Listings Accumulate... Unsold Units Also Surge

As prices fall and transactions slow, listings are accumulating. According to real estate big data company Apartment Real Transaction Price, the total number of apartment listings in Incheon reached 26,430 as of this date, an increase of 8,903 units (50.7%) since the beginning of the year. This is the highest figure in 22 months since July 2020. By region, Yeonsu-gu increased from 3,407 to 5,102 listings, a rise of 1,695 units (49.7%), and Seo-gu increased from 3,911 to 5,965 listings, up 2,054 units (52.5%).

Unsold housing units are also increasing. According to the Ministry of Land, Infrastructure and Transport's statistical portal, the number of unsold houses in Incheon stood at 532 units as of the end of March this year, a 30.1% increase from 409 units the previous month. Compared to 132 units in the same period last year, it has increased more than fourfold. For example, 'Songdo Lux Ocean SK View' held its second non-priority subscription on the 3rd, but 3 out of 16 units remained unsold. In the case of 'Songdo Central Park River Rich,' 5 out of 18 units remained unsold in the seventh non-priority subscription held on the 2nd.

The apartment sales supply-demand index in Incheon is also declining. In the third week of May, Incheon's supply-demand index was 92.9, down 6.4 points from 99.3 in the first week of January (as of the 3rd). Song Seung-hyun, CEO of Urban and Economy, explained, "In Incheon, housing prices have risen significantly over time, leading to accumulated price fatigue among buyers. Coupled with strengthened loan regulations and additional interest rate hike burdens, the buying pressure has increased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.