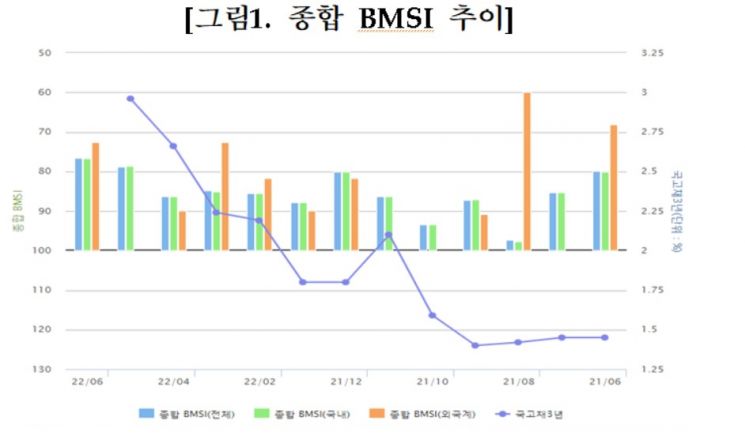

Comprehensive BMSI 76.7... 2.2p ↓ MoM

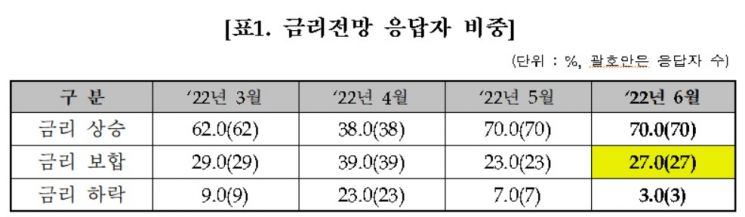

94% of Bond Investors Bet on Bank of Korea Rate Hike

Exchange Rate BMSI 44.0... Dollar Strength Expected Compared to Last Month

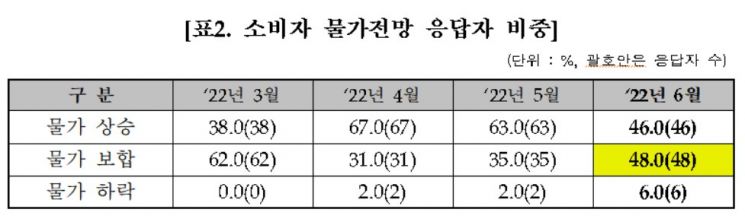

Inflation Expected to Continue Rising

"Bond Market Volatility to Be High from June to August"

[Asia Economy Reporter Hwang Yoon-joo] Nine out of ten bond market participants expected the Bank of Korea to raise the base interest rate at the May Monetary Policy Committee meeting. They also anticipated a rise in the won-dollar exchange rate and forecast that inflation would remain at a high level. As a result, the bond market sentiment index for June also showed a deterioration compared to the previous month.

The Korea Financial Investment Association announced on the 24th that the comprehensive BMSI (Bond Market Sentiment Index) for June recorded 76.7, a slight decline from the previous month (78.9).

BMSI is a survey conducted among bond holders and operators to gauge investment sentiment in the bond market. A score above 100 indicates rising bond prices (falling interest rates), while a score below 100 indicates falling bond prices (rising interest rates), meaning investment sentiment is contracting.

Specifically, the base interest rate BMSI was 6.0, showing a significant deterioration from the previous month (50.0). 94.0% of survey respondents expected the base interest rate to be raised at the June Monetary Policy Committee meeting, while only 6.0% anticipated it would remain unchanged.

The increased likelihood of additional rate hikes by the U.S. Federal Reserve (Fed) and the ongoing rise in U.S. inflation are considered influential factors. The Bank of Korea is also expected to continue its tightening stance.

The inflation BMSI rose to 60.0 from 39.0 in the previous month. Although inflation-related bond market sentiment improved, it still remained below 100. Rising inflation is negative for the domestic bond market because sustained inflation increases inflation expectations, leading to higher interest rates (lower bond prices).

On the same day, the Bank of Korea released the 'May Consumer Sentiment Survey' results, showing the expected inflation rate at 3.3%, the highest in 9 years and 7 months since October 2012 (3.3%).

Bond market sentiment related to the exchange rate also worsened compared to the previous month. The exchange rate BMSI dropped 20 points to 44.0 from 64.0. 61.0% of respondents expected the exchange rate to rise, an increase of 24.0 percentage points from the previous month. Meanwhile, 34.0% expected the exchange rate to remain stable.

This is also seen as a result of the prevailing expectation that the Fed will raise the base interest rate further, coupled with ongoing inflation, which has supported the continued strength of the dollar.

Consequently, bond market sentiment related to market interest rates also declined. The interest rate outlook BMSI fell slightly to 33.0 from 37.0 in the previous month.

Kim Sang-hoon, a researcher at Hana Financial Investment, analyzed, "Volatility in the bond market will be high from June to August this year, with significant fluctuations in bond yields. If the Bank of Korea further lowers its domestic growth forecast, changes in the pace of monetary policy are expected, which could mark the beginning of a bullish market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)