Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF)

Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF) [Image source=EPA Yonhap News]

[Asia Economy Reporter Jeong Hyunjin] "The global economy is facing its greatest test since World War II."

On the 23rd (local time) at the World Economic Forum Annual Meeting (WEF, Davos Forum) held in Davos, Switzerland, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), expressed concerns that the global economy might fall into a recession. She pointed out, "Russia's invasion of Ukraine has devastated lives, dragged down economic growth, and pushed inflation higher." She also mentioned that the IMF might revise downward its global economic growth forecast of 3.6% for this year, which was released last month.

At the Davos Forum, held for the first time in two years and four months since the COVID-19 pandemic, key figures voiced concerns about a recession. The ongoing supply chain disruptions caused by the pandemic over the past two years, coupled with the Ukraine war and China's lockdown measures, have led to soaring raw material prices and rising inflation, while global tightening monetary policies are also delivering blows. Klaus Schwab, Chairman of the WEF, described Russia's invasion of Ukraine as a "turning point in history" and emphasized that "it will reshape our political and economic landscape for years to come."

Levels of Crisis Vary by Region... Impact of the Ukraine War

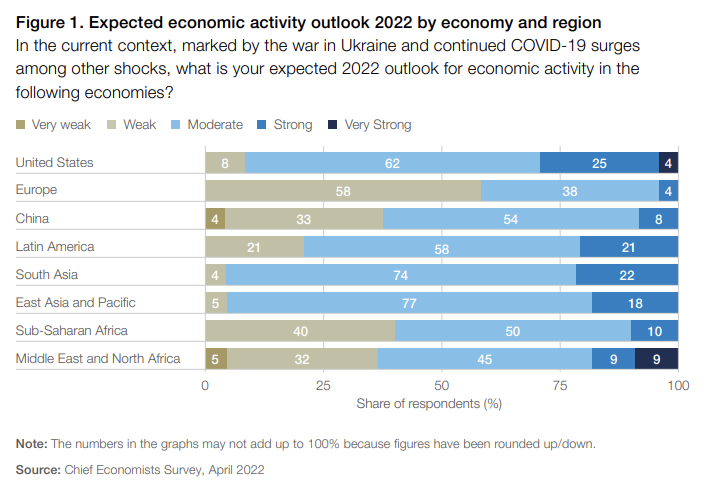

While expressing concerns about a recession, Managing Director Georgieva predicted regional differences. The area most focused on for recession concerns was Europe. In a survey released by the WEF that day, global chief economists assessed the situation more pessimistically than six months ago, expecting economic activity in the US, China, and major emerging countries to be at a 'moderate' level this year, but Europe was forecasted to be one level lower at a 'weak' level. More than 90% of the 24 respondents expected high or very high inflation in Europe and the US this year.

Jane Fraser, CEO of Citigroup, pointed out that Europe is facing a recession while other regions are experiencing economic slowdowns, highlighting crises in supply chains and energy in Europe. Robert Habeck, German Vice Chancellor and Minister for Economic Affairs, said, "I am concerned that we might head toward a global recession due to impacts not only on the climate but also on global stability."

In fact, on the same day, Christine Lagarde, President of the European Central Bank (ECB), indicated that to respond to soaring inflation, the ECB might raise interest rates for the first time in 10 years in July and could end negative interest rates by the end of the third quarter.

Limits of the Fed... "Interest Rate Hikes Won't Produce Food"

Economic experts gathered in Davos said that the US is not out of danger but there are still ways to avoid the worst. CEO Fraser said, "Much depends on what interest rate hike strategy the US Federal Reserve (Fed) implements amid soaring inflation," adding, "There is a buffer. It depends on whether it is used wisely or not."

Joseph Stiglitz, Nobel laureate and professor at Columbia University attending the WEF, emphasized in an interview with Bloomberg TV that the Fed needs to intervene on the supply side rather than raising interest rates. He said, "Raising interest rates will not solve the price problem," and pointed out, "(Interest rate hikes) do not produce more food. This will cause more difficulties and make investment harder."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.