[Asia Economy Reporter Lee Seon-ae] NH Investment & Securities on the 24th issued a 'Positive' investment opinion for both the refining industry and the petrochemical industry.

Choi Young-kwang, a researcher at NH Investment & Securities, stated, "As the strong refining margin is expected to continue for a long time, we recommend increasing the weighting of the refining industry. Although the petrochemical industry is facing three difficulties?weak demand, oversupply, and increased costs?the cost burden is expected to ease and demand is expected to improve, indicating that the bottom of the business cycle is near. Despite the challenging environment, we recommend increasing the weighting of companies expected to expand their valuation based on investments in new growth engines."

Currently, the petrochemical business environment is affected by three adverse factors: weak demand due to China's shutdowns and economic slowdown, oversupply caused by increased expansion volume, and cost burdens intensified by high oil prices.

Researcher Choi said, "Although oversupply will continue in the second half of the year, cost burdens will ease along with the gradual decline in oil prices. With economic recovery due to reopening and expectations for China's economic stimulus measures, demand is expected to gradually recover compared to the first half, leading to a gradual improvement in operating profit in the second half."

He predicted that the strong refining margin would continue. He judged, "Although international oil prices are expected to gradually stabilize downward, the tight supply and demand of petroleum products will be difficult to resolve in the short term."

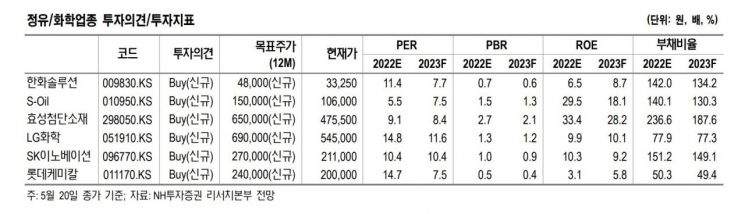

He presented Hanwha Solutions as his top pick. Researcher Choi said, "It holds a product portfolio relatively free from oversupply, and a turnaround in the renewable energy sector is expected due to the decline in polysilicon prices following large-scale expansion."

As his second favorite stock, he selected S-Oil (S-OIL). He explained, "Although the currently elevated refining margin will gradually stabilize downward, it is expected that the refining margin will remain higher than in the past until 2023, allowing the company to fully benefit from this."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.