[Industry and Wealth Landscape Changed by COVID-19]

Samsung Electronics Remains Unchallenged as the Top 1 Among the 500 Largest Companies by Revenue

Second Battery Companies Like LG Chem and EcoPro BM Show Remarkable Growth

IT and Gaming, 'Pandemic Beneficiaries,' Face Operating Profit Decline Due to Rising Labor Costs

Endemic and Interest Rate Hikes Make Previous Growth Rates Difficult to Expect

[Asia Economy Reporter Kwon Jaehee] Even after the COVID-19 pandemic, Korea’s leading industries remained semiconductors and secondary batteries. Despite the pandemic, these core industries solidified their status by showing explosive growth in operating profits. IT companies, including platforms, also showed remarkable growth, but due to rising labor costs caused by a shortage of IT developers, the increase in operating profit relative to sales was sluggish. This is attributed to the rapid digital and contactless transformation across industries during COVID-19, which drove up developers’ market value.

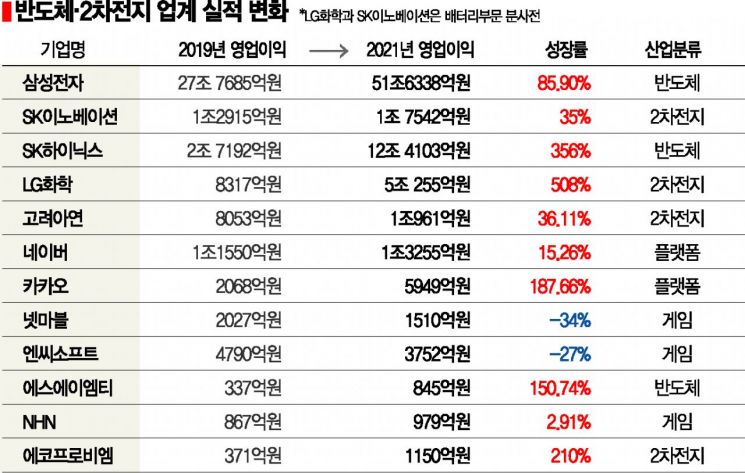

On the 23rd, Asia Economy analyzed the performance of the top 500 companies by sales in 2019 and 2021, revealing the prominent growth of semiconductor and secondary battery sectors. Samsung Electronics remained the undisputed number one among the top 500 companies by sales, with an 85.90% increase in operating profit from 2019 to 2021. SK Hynix’s growth was particularly notable, recording a 356% increase in operating profit during the same period. As memory demand surged, SK Hynix aggressively increased production, resulting in a sharp profit rise. Semiconductor material and equipment companies also recorded operating profit growth rates exceeding 100%. For example, SAMT’s operating profit growth rate was 150.74%, jumping from 228th in sales ranking in 2019 to 160th in 2021. DB HiTek also achieved a 120.13% increase in operating profit during this period.

Secondary battery companies also enjoyed dazzling growth. LG Chem (before the spin-off of LG Energy Solution) stood out, with an operating profit growth rate of 504% from 2019 to 2021. In 2021, LG Chem’s operating profit surpassed 5 trillion KRW, marking an all-time high. This was attributed to its market-leading position in the secondary battery market combined with a boom in the chemical sector. EcoPro BM and Korea Zinc also showed notable profit growth, with EcoPro BM’s operating profit increasing by 210% and Korea Zinc’s by 36.11% during the same period.

The IT and gaming sectors also showed remarkable growth due to the COVID-19 pandemic. However, the rapid increase in digital and contactless demand across industries led to rising developer wages, causing somewhat sluggish growth in operating profit margins.

Among platforms, Kakao’s growth was more striking than Naver’s. Kakao’s sales nearly doubled, growing by 99.9%, and its operating profit increased by 187.66% during this period. Meanwhile, Naver’s sales grew by 56%, and operating profit by 15.26%.

Game companies also benefited from the COVID-19 pandemic, but most recorded negative growth rates in operating profit. Netmarble’s operating profit growth rate was -34%, NCSoft’s -27%, and Com2uS’s -69%. However, all showed sales growth: Netmarble, NCSoft, and Com2uS increased sales by 15.06%, 35.71%, and 19.04%, respectively. This was mainly due to the heavy burden of developer labor costs compared to other sectors. In fact, in the past one to two years, salary increases have been implemented mainly for developer positions. NCSoft raised salaries by 13 million KRW for developers and 10 million KRW for non-developers; Krafton increased developer salaries by 20 million KRW and non-developer salaries by 15 million KRW. Nexon, Netmarble, Com2uS, and Pearl Abyss also uniformly raised salaries by 8 million KRW, pushing starting salaries for developers above 50 million KRW. The labor cost increase rates for major game companies were 54% for Wemade, 50% for Com2uS, 46% for Kakao Games, 42% for Krafton, 33% for Pearl Abyss, 26% for Nexon, 20% for Netmarble, and 18% for NCSoft, far exceeding the average labor cost increase rate in Korea, leading to deteriorated profitability.

However, with the COVID-19 endemic phase and the U.S. interest rate hikes, the attractiveness of growth stocks has declined, making it difficult to expect previous IT industry growth trends. Game stocks recorded an average price-to-earnings ratio decline of -44.77% compared to the beginning of the year, with many hitting 52-week lows. Platform companies like Kakao and Naver also recorded 52-week intraday lows on the 19th. Consequently, the securities industry has collectively lowered their price targets for game stocks.

Samsung Securities downgraded its investment opinion on Krafton to 'neutral' and lowered the target price by about 9% to 300,000 KRW. Especially for Netmarble, which posted an operating loss in Q1, Ebest Investment & Securities cut the target price from 146,000 KRW to 105,000 KRW (28%↓), Korea Investment & Securities from 140,000 KRW to 100,000 KRW (28.57%↓), Shinhan Financial Investment from 150,000 KRW to 80,000 KRW (46.67%↓), and Samsung Securities from 140,000 KRW to 100,000 KRW (28.57%↓). Hyundai Motor Securities also lowered Kakao’s target price to 130,000 KRW.

Lee Gyuik, a researcher at Cape Investment & Securities, said, "The biggest factors affecting game stocks are 'new releases' and structural 'growth' through expansion into new markets, but due to the delayed diversification of game genres and risks to new growth engines, meaningful increases are unlikely in the near term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.