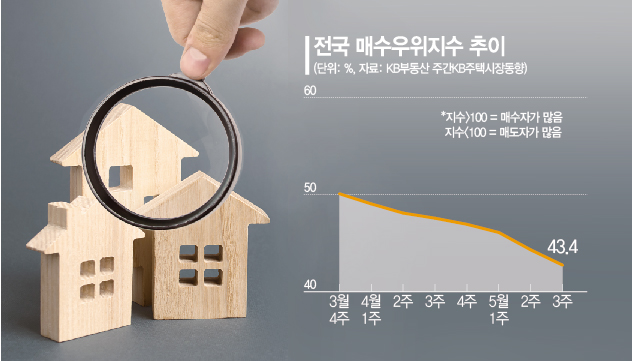

Last Week's Net Buying Index at 43.4

Seven Consecutive Weeks of Decline

Buyers Hold Back Amid Perception of Peak Housing Prices

Increase in Transaction Prices Also Shows a Moderate Trend

[Asia Economy Reporter Hwang Seoyul] Since the launch of the Yoon Seok-yeol administration, the number of properties for sale has been increasing, but buyers have been reluctant to make moves. As the perception of housing prices being at their peak and buyers' cautious stance continue, some areas are showing a downward trend in transaction prices. Attention is focused on whether this weakened buying sentiment will lead to a decline in housing prices.

According to the weekly KB Housing Market Trend released by KB Real Estate on the 23rd, the buyer dominance index last week was 43.4, marking a decline for seven consecutive weeks since the fourth week of March. This is the lowest level since the fourth week of September 2019 (44.1). The buyer dominance index is measured within a range of 0 to 200, where a value above 100 indicates more buyers in the market, and below 100 indicates more sellers.

By region, the buyer dominance index also shows low figures. Last week, the buyer dominance index in the metropolitan area recorded 40.4, declining for three consecutive weeks. The same trend was observed in Seoul, where both Gangbuk and Gangnam saw the buyer dominance index fall for three straight weeks. Gangbuk decreased from 60.5 in the fourth week of April to 55.6 last week, while Gangnam dropped from 63.3 to 58.6 during the same period.

Provincial metropolitan cities showed even weaker buying power compared to the metropolitan area. Except for Incheon, the five major metropolitan cities recorded 30.0 last week. In particular, Daegu and Daejeon were recorded at 21.3 and 19.5 respectively, about half the level of the metropolitan area. Other provinces showed a relatively better figure of 63.1, but considering that it ranged from 96.7 to 107.5 as recently as October last year, this is quite low.

According to the real estate big data platform Asil, comparing the increase and decrease in listings between the 9th, before the one-year temporary exclusion policy on capital gains tax surcharges for multi-homeowners was implemented, and the current date, listings have increased in all cities and provinces except Jeju. However, due to the perception of housing prices being at their peak, buyers are not jumping in easily. The KB Apartment Transaction Price Index took 5 years and 3 months to rise from the 70 level in July 2015 (70.2) to the 80 level in October 2020 (80.3), but it only took 1 year and 3 months to rise from the 80 level to the 100 level by January last year (100.0).

As the cautious stance continues, the increase in apartment transaction prices is also becoming more gradual. This year, the nationwide transaction price change rate compared to the previous week has remained in the two decimal places. Last week, it increased by only 0.03% compared to the previous week, contrasting with the surge to 0.51% in the second week of February last year. With transactions becoming difficult unless they are urgent sales, some areas even showed negative growth rates compared to the previous week. Daegu, where unsold properties have recently been increasing, saw a 0.11% decrease in transaction prices last week compared to the previous week. Sejong, where prices soared two years ago, recorded -0.45%. In Seoul, Nowon-gu (-0.04%), Seongbuk-gu (-0.05%), and Gangdong-gu (-0.01%) also experienced declines in transaction prices.

Lee Hyun-cheol, director of the Apartment Cycle Research Institute, said, "When buying power decreases, properties in the pre-sale market also do not sell," adding, "Since pre-sale properties must be sold unconditionally, sellers in the subsequent transaction market inevitably face downward pressure on prices." He further noted, "The case of Daegu is just an early indicator, and such phenomena could expand to other regions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.