[Asia Economy Reporter Kim Jin-ho] Concerns have been raised that the number of 'marginal companies'?those unable to cover interest expenses with operating profits?will significantly increase if interest rates rise further due to monetary tightening policies by major countries.

The Federation of Korean Industries (FKI) announced on the 23rd that an analysis of 17,827 publicly audited companies showed that the proportion of temporary marginal companies, whose operating profits were less than interest expenses last year, stood at 34.1%.

It was found that if the financing interest rate rises by 3 percentage points due to interest rate fluctuations, the proportion of temporary marginal companies would increase to 47.2%. By industry, the majority of accommodation and food service sectors (84.3%) would become temporary marginal companies, and 35.4% of large corporations would also be classified as marginal companies.

Over the past five years, the number of temporary marginal companies unable to cover interest expenses with operating profits has been steadily increasing. Last year, temporary marginal companies accounted for 34.1% (6,080 companies) of publicly audited companies, or about one in three. This figure is 2.5 percentage points lower than the 36.6% recorded the previous year, which was heavily impacted by COVID-19, but it represents a 6.0 percentage point increase compared to 2017.

By industry, accommodation and food service sectors accounted for 76.4%, and by company size, one in three small and medium enterprises (35.5%) and one in four large corporations (27.6%) were temporary marginal companies.

In particular, assuming operating profits remain the same and the company’s financing interest rate fluctuates by 1 to 3 percentage points, a 1 percentage point increase in interest rates would raise the proportion of temporary marginal companies by 5.4 percentage points, with additional interest expenses amounting to 8.69 trillion KRW.

If interest rates rise by 2 percentage points, temporary marginal companies would increase by 9.5 percentage points, with additional interest expenses of 17.92 trillion KRW. A 3 percentage point increase would raise temporary marginal companies by 13.1 percentage points and additional interest expenses by 26.88 trillion KRW.

This means that if the base interest rate rises and corporate financing rates increase by 3 percentage points, half of the publicly audited companies would be unable to cover even their interest expenses with operating profits.

By industry, a 3 percentage point increase in interest rates would sharply increase temporary marginal companies in manufacturing (14.9 percentage points), electricity, gas, steam and water supply (14.6 percentage points), and real estate (16.7 percentage points). By company size, even large corporations would see the proportion of temporary marginal companies rise to 35.4% with a 3 percentage point interest rate increase.

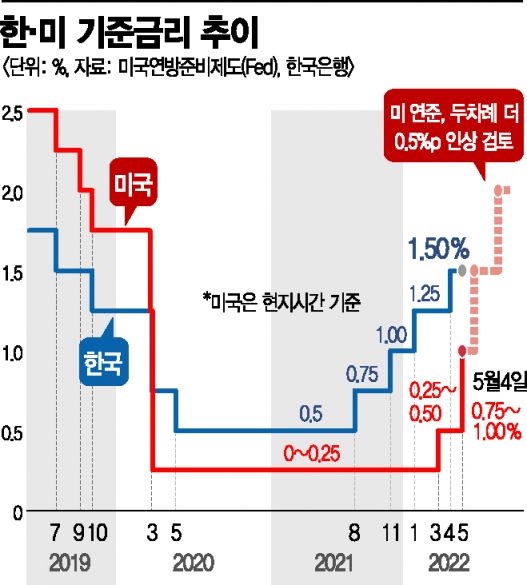

Yoo Hwan-ik, head of the Industry Division at FKI, said, “Given the current economic situation, with inflation concerns and the U.S. Federal Reserve’s base rate hikes, South Korea has no choice but to raise its base interest rate as well. Rapid interest rate hikes are likely to produce many marginal companies, which could burden the economy. Therefore, it is necessary to implement policies while considering their impact on the economy.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.