[Industry and Wealth Landscape Changed by COVID-19]

Bang Si-hyuk, Jang Byung-gyu Among Stock Millionaires

Clear Recovery of Losses Immediately After COVID-19

[Asia Economy Reporter Lee Seon-ae] Over the past two years of the COVID-19 pandemic, significant changes have occurred in the stock wealth of Korea’s richest shareholders. Emerging wealthy individuals from sectors that greatly benefited from the pandemic have appeared one after another. Most stock-rich individuals overcame the sharp decline in equity value caused by the spread of COVID-19 and saw their valuations soar, boasting substantial stock wealth.

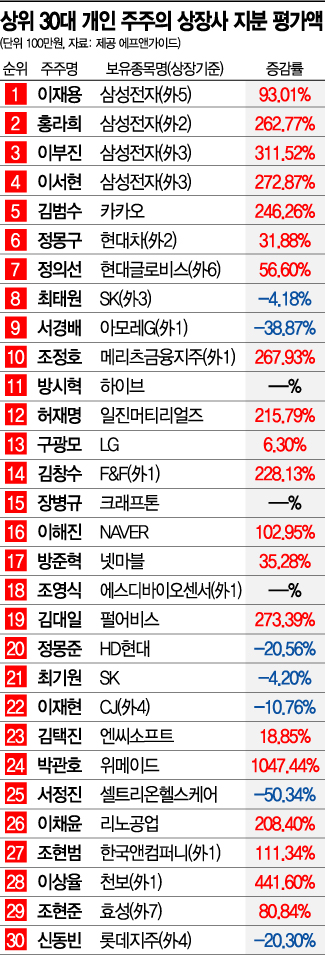

According to financial information firm FnGuide on the 23rd, new figures appeared among the top 30 richest stockholders as of the end of last year. The key figures are Chairman Bang Si-hyuk, Chairman Jang Byung-gyu of Krafton, and Chairman Cho Young-sik of SD Biosensor. Their companies experienced rapid growth and successful listings, benefiting significantly from the pandemic. Their equity valuations were recorded at 4.5898 trillion KRW, 3.2328 trillion KRW, and 1.8225 trillion KRW, respectively. Consequently, Chairman Bang ranked 11th among the richest stockholders, while Chairman Jang and Chairman Cho ranked 15th and 18th, respectively.

The sharp rise in stock prices of gaming, bio, and content sectors due to social distancing during the COVID-19 spread was clearly reflected in the changes in wealth.

Park Kwan-ho, Chairman of Wemade, ranked 24th with an equity valuation of 2.6392 trillion KRW, marking a staggering increase of 1047.44%. This was the highest growth rate among the top 30 and the only one exceeding 1000%. The surge was driven by the blockbuster success of Wemade’s new game, "Mir4." "Mir4" incorporated blockchain technology, allowing the in-game core currency "Black Iron" to be exchanged for a utility token called "DRACO," raising investor expectations. As a result, WemadeMax was identified as the stock with the highest price increase in the domestic stock market from the first trading day to the last of last year, January 4 to December 28, across both KOSPI and KOSDAQ markets, with a rise of 1499.31%. Wemade ranked third among stocks with the highest price increases, soaring 846.06%.

The equity valuations of other gaming stock-rich individuals also jumped significantly. Kim Dae-il, Chairman of Pearl Abyss, saw his equity valuation rise to 3.2573 trillion KRW, an increase of 273.39%. A financial investment industry insider commented, "The stocks with the highest gains last year were in gaming, metaverse, and content sectors," adding, "This likely had a considerable impact on individual shareholder rankings." Indeed, except for Edison EV, which ranked second with a 1244.38% increase, the top 10 stocks with the highest price increases were all related to gaming, metaverse, and content. Six stocks?Wysiwyg Studios (527.32%), Devsisters (513.15%), Com2uS Holdings (491.59%), Neowiz Holdings (446.95%), NP (421.20%), and Dexter (418.23%)?ranked from 4th to 10th in price increase rates.

The rapid growth of Naver and Kakao also led to sharp increases in the equity valuations of Lee Hae-jin, Global Investment Officer (GIO) of Naver, and Kim Beom-su, Head of Kakao Future Initiative Center. Their increases were 246.26% and 102.95%, respectively. Notably, excluding the Samsung family, Kim is the top stock-rich individual, solidifying his position at 5th overall.

The equity values of leaders in the emerging secondary battery industry also surged. Lee Sang-yul, CEO of Cheonbo, recorded an equity valuation of 1.2002 trillion KRW, a 441.60% increase. Huh Jae-myung, Chairman of Iljin Materials, ranked 12th with an equity valuation of 3.318 trillion KRW, up 21.79%.

Only six stock-rich individuals among the top 30 saw decreases in their equity valuations. The chairmen of groups centered on distribution sectors, which were severely impacted by COVID-19, experienced declines: Lee Jae-hyun, Chairman of CJ Group (CJ and four other companies), and Shin Dong-bin, Chairman of Lotte Group (Lotte Holdings and four other companies), saw their equity valuations fall by 10.76% and 20.30%, respectively. Seo Kyung-bae, Chairman of AmorePacific Group (AmoreG and one other company), also saw a 38.87% decrease.

Meanwhile, the equity valuations of the Samsung family members ranked 1st to 4th among stock-rich individuals?Lee Jae-yong, Vice Chairman of Samsung Electronics; Hong Ra-hee, former Director of Samsung Museum Leeum; Lee Boo-jin, President of Hotel Shilla; and Lee Seo-hyun, Director of Samsung Welfare Foundation?increased by 93.01%, 262.77%, 311.52%, and 272.87%, respectively.

The total equity valuation of the top 30 increased by 109.14%, from 49.7496 trillion KRW at the end of 2019 to 104.0502 trillion KRW at the end of 2021. Although equity valuations plunged sharply in March 2020 due to the onset of the COVID-19 pandemic, stock wealth has fully recovered.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)