Hanjayeon Emphasizes Importance of Supporting R&D Projects Through Report

Competitor Countries Strengthen Government-Level Support

[Asia Economy Reporter Yoo Hyun-seok] The domestic automotive parts industry has been criticized for failing to proactively and actively respond to the paradigm shift in the industry due to poor performance. There are calls for the government to expand research and development (R&D) and workforce budget support for the automotive industry.

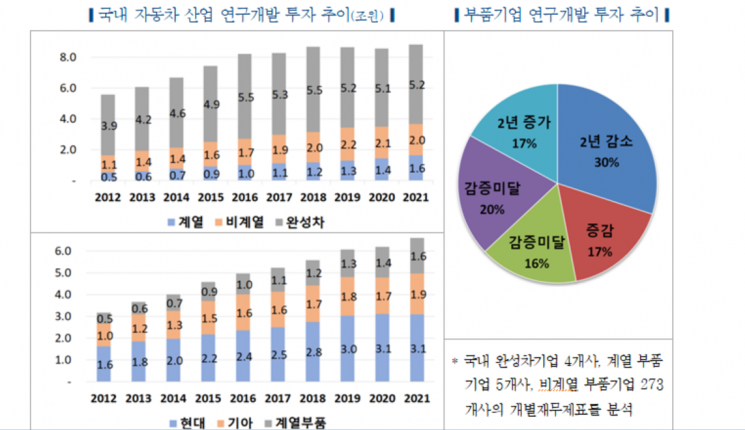

The Korea Automotive Technology Institute (KATRI) stated in its report titled "The Two Major Innovation Pillars of the Shaking Automotive Industry," released on the 23rd, "Unlike competing countries that are actively fostering the automotive industry, R&D investment by non-affiliated parts companies of domestic automakers is decreasing."

According to KATRI, the automotive industry ranks third worldwide in R&D investment, accounting for 16% of global investment.

Additionally, to mass-produce electric-powered and software-based vehicles by 2026, automotive and related companies are expanding R&D and human capital investments, and major governments are also strengthening infrastructure related to future vehicles. A representative example is the German automotive industry's planned R&D investment of a total of 220 billion euros (approximately 295.8 trillion KRW) from 2022 to 2026.

On the other hand, in Korea, although overall R&D investment in the automotive industry has increased, R&D investment by 273 non-affiliated parts companies of automakers is on a declining trend. From 2020 to 2021, Hyundai Motor Group's R&D investment increased by 409.4 billion KRW, while the investment by two foreign-affiliated automakers, Renault Korea Motors and SsangYong Motor, decreased by 99.9 billion KRW.

Investment by non-affiliated parts companies also decreased by 37.8 billion KRW. Among the 273 non-affiliated parts companies, 85 companies saw their R&D investment decline for two consecutive years after COVID-19. KATRI diagnosed that "this trend could hinder the transition to future vehicles."

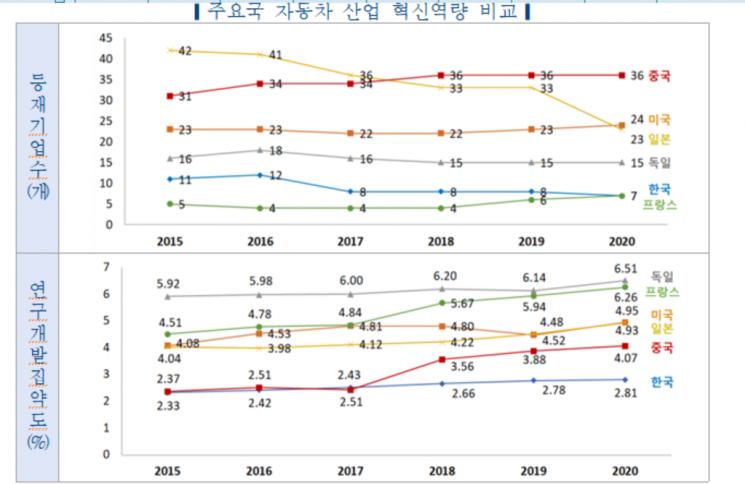

Furthermore, as competing countries' automotive companies expand R&D investment and increase specialized personnel, the widening gap in innovation capabilities between companies is expected to deepen polarization within the domestic automotive industry.

As of 2020, major countries' automotive industry R&D investments were 59 trillion KRW in Germany, 33 trillion KRW in Japan, 30 trillion KRW in the United States, and 12 trillion KRW in China, with Korea trailing significantly at 8.6 trillion KRW.

In 2020, the number of automotive engineers in the U.S. and Germany increased to 110,000 and 126,000 respectively, but the domestic automotive industry's R&D workforce decreased by 929 from 2018 to 2020, totaling only 37,000.

KATRI emphasized, "As automobiles evolve into mobility and the scope of related upstream and downstream industries expands, it is necessary to increase budget support for related R&D." It added, "In the long term, a dual strategy should be operated to support both companies that have invested in R&D over a long period and startups with core competencies, while ensuring the stability of the mobility industry's supply chain."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)