215,816 Transactions... Record High

Continued Increase in Capital Region Share... 60.39%

Vacancy Rate Down, Rent Up, Rental Income Improvement Expected

[Asia Economy Reporter Hwang Seoyul] Transactions of commercial and office real estate reached a record high last year. The proportion of the metropolitan area increased year by year, accounting for 60% of the transactions. Due to the endemic impact, rental income is also expected to improve, drawing attention to commercial and office real estate.

According to the Korea Real Estate Board on the 22nd, last year, 215,816 transactions of commercial and office real estate excluding officetels were recorded. This is the highest number since the Korea Real Estate Board began releasing related statistics in 2017. Statistics on commercial and office facilities excluding officetels are classified under the 'Others' category.

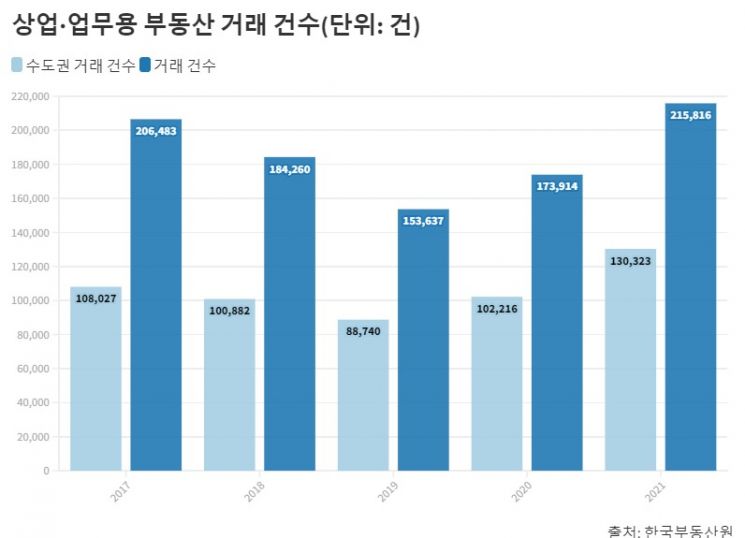

The volume of commercial and office real estate transactions, which had been declining, rebounded from 2020. The total transaction volume was 206,483 in 2017 but decreased to 184,260 in 2018 and further to 153,637 in 2019. However, it increased again to 173,914 in 2020 and reached a record high of 215,816 last year.

The proportion of the metropolitan area in commercial and office real estate has steadily increased, reaching the 60% range. It was 52.32% in 2017, 54.75% in 2018, 57.76% in 2019, 58.77% in 2020, and 60.39% in 2021.

With the lifting of social distancing due to the endemic, rental income for commercial and office real estate is expected to improve. According to the Korea Real Estate Board's survey, the vacancy rate for small-scale commercial facilities nationwide in the first quarter of this year was 6.4%, down 0.4 percentage points from 6.8% in the fourth quarter of last year. The vacancy rate for medium to large stores also recorded 13.2% in the first quarter of this year, a decrease of 0.3 percentage points from 13.5% in the fourth quarter of last year.

Rental fees slightly rebounded for the first time since the first quarter of 2020. The rental fee per square meter (supply area) for small-scale stores nationwide rose by 400 won to 19,400 won compared to the previous quarter. For small-scale stores, the rental fee per square meter dropped from 20,000 won in the first quarter of 2020 to 19,000 won in the fourth quarter of last year. The rental fee for medium to large stores increased by 100 won per square meter from the previous quarter to 25,500 won.

In the auction market, the average winning bid rate for commercial and office facilities last month was 123.4%, the second highest ever. The highest winning bid rate was 125% in March of last year.

Park Daewon, director of the Commercial Information Research Institute, said, "The commercial and office real estate market itself was rigid but is now returning to normal," adding, "Both the startup market and the commercial real estate investment market are becoming active." However, Park cautioned, "Due to interest rate hikes and rising sale prices, the actual yield may not be as high as expected, so investors should be careful from an investment perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.