Yuanta Securities Report

[Asia Economy Reporter Lee Myunghwan] As domestic reopening (resumption of economic activities) gains momentum, securities firms have analyzed that related indicators are rebounding. There is also a forecast that the earnings of companies related to reopening will significantly increase.

On the 21st, Yuanta Securities analyzed that the recovery of reopening-related figures is being confirmed.

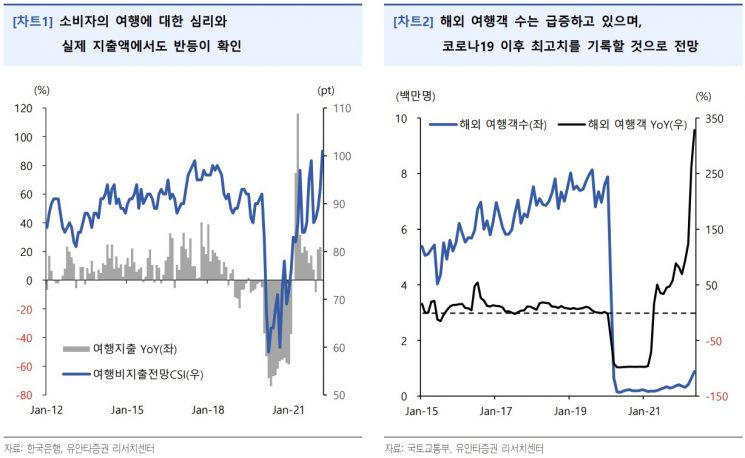

Due to expectations of reopening, it is explained that a rebound in indicators related to travel demand is being confirmed. Travel expenditure, a sub-item of the travel balance, sharply declined from $2.63 billion (approximately 3.34 trillion KRW) in January 2020 but has rebounded since February this year. As of March, travel expenditure recovered to about $1.28 billion (approximately 1.62 trillion KRW).

Psychological indicators are also evaluated to be improving. The Consumer Sentiment Index (CSI) for travel expenditure outlook, which had fallen to a low of 59 points due to COVID-19, surged to 101 points last month. This is a high figure even compared to before the COVID-19 outbreak and is the highest level since July 2008.

The number of overseas travelers is also showing a clear recovery trend. The number of overseas travelers, which had decreased to 137,000 in May 2020, exceeded 510,000 as of the 18th. It is expected to record the highest monthly number of travelers since the COVID-19 pandemic by the end of this month. It is explained that travel demand, which had been limited domestically, is spreading overseas again.

Yuanta Securities explained that expectations for reopening have existed from before. However, while there was only vague anticipation for reopening in the past, the current expectations are based on the recovery and rebound of figures and earnings.

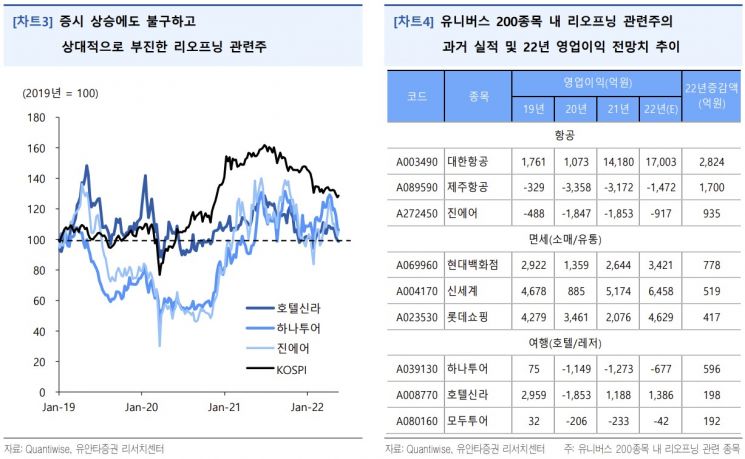

Due to the impact of COVID-19, reopening-related industries experienced difficult times, and during that process, some airlines and travel agencies conducted paid-in capital increases for operating funds and debt repayment. Despite the stock market rise, their stock prices were relatively sluggish, but it is judged that the recovery trend of related indicators will be reflected in the earnings of these stocks going forward.

They forecast that the operating profits of major airline, duty-free, and travel-related stocks within the 'Universe 200 stocks' will significantly improve this year compared to last year. Researcher Cho Changmin of Yuanta Securities said, "It can be interpreted that the recovery of figures has already begun to be reflected in earnings," adding, "The normalization of travel demand, which has started to rebound, will soon lead to the normalization of earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.