[Asia Economy Reporter Lee Seon-ae] Advice has been given to focus on the intersection of oversold stocks and quality stocks during short-term rallies.

According to the Korea Exchange on the 21st, the KOSPI closed at 2,639.29, up 46.95 points (1.81%) from the previous day. The index, which had fallen more than 1% the previous trading day and dropped below the 2,600 level, rebounded in one day to recover the 2,630 level.

Lee Kyung-min, a researcher at Daishin Securities, analyzed, "The KOSPI rose due to simultaneous buying by foreigners and institutions," adding, "Ahead of the Korea-US summit, large-cap stocks with high market capitalization such as semiconductors and secondary batteries rose on expectations of benefits from cooperation between the two countries, driving the KOSPI's increase."

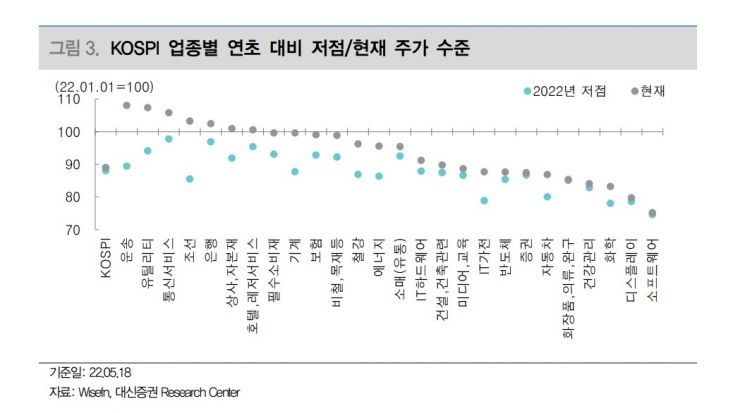

The securities industry views that a short-term relief rally is possible once concerns and negative factors begin to ease. Jo Jae-woon, a researcher at Daishin Securities, said, "Although the overall economic situation and corporate profit outlook remain uncertain, a short-term relief rally is possible once concerns and negative factors start to ease," explaining, "Because a large amount of concerns and negative factors emerged in a short period, investors' overreactions led to excessive declines in stock prices."

Jo added, "Since investment conditions are unfavorable, when selecting oversold stocks, it is necessary to consider not only the magnitude of the decline but also stable and high-quality profits," further explaining, "Currently, due to rising interest rates and inflation, resilience and recovery conditions are limited."

Therefore, in a relief rally, attention should be paid to ▲ the intersection of oversold stocks and quality stocks ▲ stocks with a large drop in price-to-earnings ratio (PER) ▲ stocks with a high gap between target price and current price ▲ stocks with high-quality earnings (high ROE) ▲ stocks with low debt ratio (total debt/total capital) ▲ and industries and stocks showing stable profit trends.

By industry, among the top-scoring sectors, IT home appliances, construction/architecture, machinery, semiconductors, and IT hardware are considered promising as their earnings consensus has been revised upward despite stock price declines. As for stocks, attention should be paid to Samsung SDI, Hyundai Rotem, SK Hynix, Korea Circuit, and MCNEX. He advised, "Regardless of promising industries, Kakao, E-mart, and Hyundai Motor also have solid earnings and large declines, so they have a high potential for rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)