[Asia Economy Reporter Bu Aeri] Interest among young people in the 'Youth Leap Account,' a key presidential campaign pledge of the Yoon Seok-yeol administration known as the '100 million won account,' is growing day by day. Even before its introduction, an internet cafe called 'Cheongdogye' with 7,000 members has appeared, and related inquiries are steadily being posted on online communities. However, concerns have also arisen in the financial sector that banks might bear the losses.

According to the financial sector on the 21st, the Yoon Seok-yeol administration plans to launch a new long-term (up to 10 years) asset formation support product called the 'Youth Long-term Asset Account (tentative name)' next year, which was not covered by existing youth support products. Kim So-young, Vice Chairman of the Financial Services Commission, said at a briefing by the Presidential Transition Committee on the 2nd, "We will actively review the direction of the 'Youth Leap Account' pledge, which is designed to help young people accumulate a large sum of money over the long term." She also stated that the Youth Long-term Asset Account will enhance fairness by differentiating benefits based on income levels and other factors.

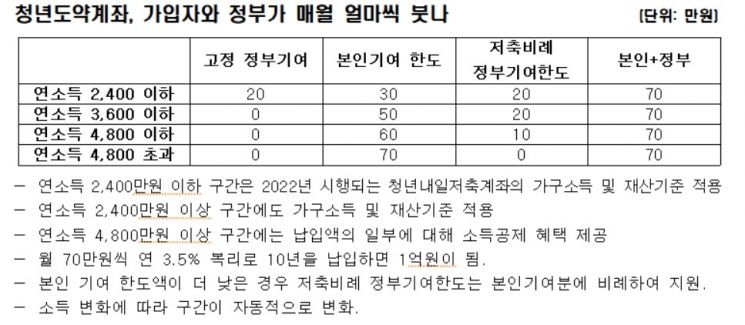

The core framework envisioned by the Yoon administration is the 'Youth Tomorrow Savings Account + Youth Long-term Asset Account.' According to the administration's campaign pledge, working youth aged 19 to 34 who save a certain amount up to a monthly limit of 700,000 won will receive government support of up to 400,000 won per month through tax exemptions, income deductions, or contributions, creating 100 million won over a 10-year maturity period. However, government benefits vary depending on income.

Regarding this, Vice Chairman Kim explained to reporters at the briefing, "Originally, the pledge was to 'make 100 million won,' so we are proceeding in a way that makes it possible to accumulate 100 million won within 10 years." She added, "If you pay 700,000 won monthly and the interest rate is 3.6%, it becomes 100 million won, but since the interest rate is uncertain, we are considering increasing it to 750,000 won and other options."

In this regard, the Financial Services Commission, the Korea Federation of Banks, commercial banks, and the Korea Financial Investment Association are currently reviewing various proposals. Especially since it is a major pledge of the new government, most of the five major commercial banks are expected to participate. However, the banking sector, which had a painful experience when the number of subscribers far exceeded expectations during the sale of the 'Youth Hope Savings' promoted by the Moon Jae-in administration, voices concerns about the implementation of this system.

A representative of a commercial bank said, "It will be difficult not to participate in policies promoted by the new government," adding, "If the government secures the budget and supports it, there will be no problem, but realistically, it seems difficult to prepare the budget, and if that happens, raising interest rates will create a structure where banks have to bear all the burdens."

Concerns about fairness were also raised. In the case of the Youth Hope Savings implemented by the Moon Jae-in administration, internet-only banks such as KakaoBank, Toss Bank, and K Bank, whose main customers are actually people in their 20s and 30s, did not participate. Because of this, commercial banks complained that internet-only banks only take the good parts and do not share the burden related to financial authorities' policies. Another bank official said, "If internet-only banks do not participate again like with the Youth Hope Savings, there will be considerable dissatisfaction regarding fairness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.