War-Induced Supply Chain Crisis Becomes a Reality<3>

[Asia Economy Reporters Sunmi Park and Jinho Kim] The prolonged Russia-Ukraine war and China's 'Zero COVID' policy-induced city lockdowns have worsened global supply chain disruptions, delivering a direct blow to the home appliance and semiconductor industries, which have a high proportion of overseas sales. Due to parts shortages, production factories are not operating smoothly, causing 'out-of-stock crises' in some regions. The sharp rise in raw material prices has also triggered increased production and logistics costs, turning on red lights for profitability management.

"Can't sell because products are unavailable"

Samsung Electronics and LG Electronics have indefinitely suspended shipments to Russia, citing global maritime logistics disruptions caused by the Russia-Ukraine war, leaving home appliance inventories in the Russian region depleted.

According to the industry on the 20th, most home appliances are out of stock at Samsung Electronics and LG Electronics' official local shopping malls in Russia and local home appliance retailers. For example, among about 60 refrigerators sold on Samsung Electronics' official Russian shopping mall, only 2 models are currently available for purchase. The situation is similar for Samsung Electronics and LG Electronics' washing machines and TVs, which are popular in Russia.

Samsung Electronics operates a factory producing TVs and monitors in the Kaluga region of Russia, and LG Electronics also has a home appliance production plant in the outskirts of Moscow, in the Luza area, but they are not receiving the necessary parts for finished product production properly. Both local factory operations and export routes for finished products have been blocked. Since Russia's invasion of Ukraine on February 24, global shipping companies have boycotted Russian cargo transport, and the U.S. has banned exports of semiconductors, smartphones, and home appliances to Russia. An insider familiar with internal affairs stated, "Considering relations with Russia, there is currently no closure or suspension of local factories," but added, "Parts procurement has become impossible, causing production lines in factories to stop intermittently."

"Can't increase production due to lack of equipment and materials"

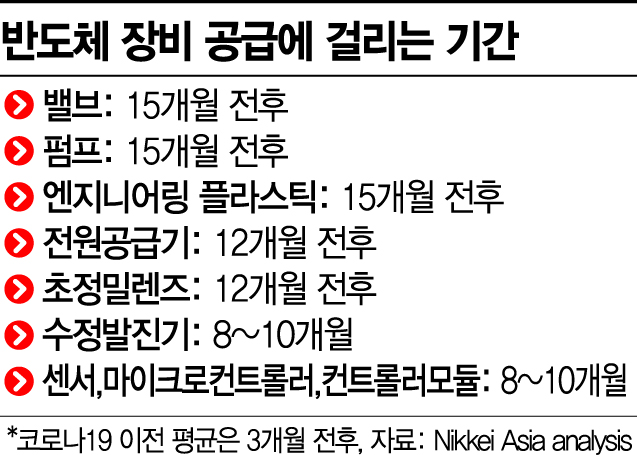

The semiconductor supply shortage is expected to continue this year as well. Even if the semiconductor industry tries to increase production, the prolonged Russia-Ukraine war has made the supply of materials, parts, and equipment (SoBuJang) needed for semiconductor production extremely tight.

Ukraine, which accounts for half of the world's production of neon, a key semiconductor material, was invaded, causing supply prices to skyrocket dozens of times compared to a year ago. As the prices of materials needed for semiconductor production surged, foundry (semiconductor contract manufacturing) companies are now considering raising semiconductor supply prices. Following industry leader TSMC's 6% production price increase for next year, Samsung Electronics is reportedly reviewing plans to raise prices by 15-20%.

Equipment capable of increasing semiconductor production is also in critically short supply. For 8-inch (200mm) wafers used in automotive semiconductors, DB HiTek and SK Hynix System IC are operating factories at full capacity, but additional investment in production facilities has become difficult. An industry insider explained, "Compared to memory semiconductors, manufacturing technology levels are not high, so production is possible with older equipment. However, since equipment manufacturers have already shifted lines to 12-inch (300mm), production for 8-inch equipment is almost non-existent, making equipment supply unstable."

As countries worldwide develop semiconductors as a national strategic industry, competition to secure advanced equipment is intensifying. Consequently, equipment lead times (time from order to delivery) have extended from several months in the past to 2-3 years currently.

Rising raw material prices push up logistics costs

Domestic electronics companies selling products globally are reflecting the burden of parts supply disruptions, raw material, and logistics cost increases directly in their corporate performance.

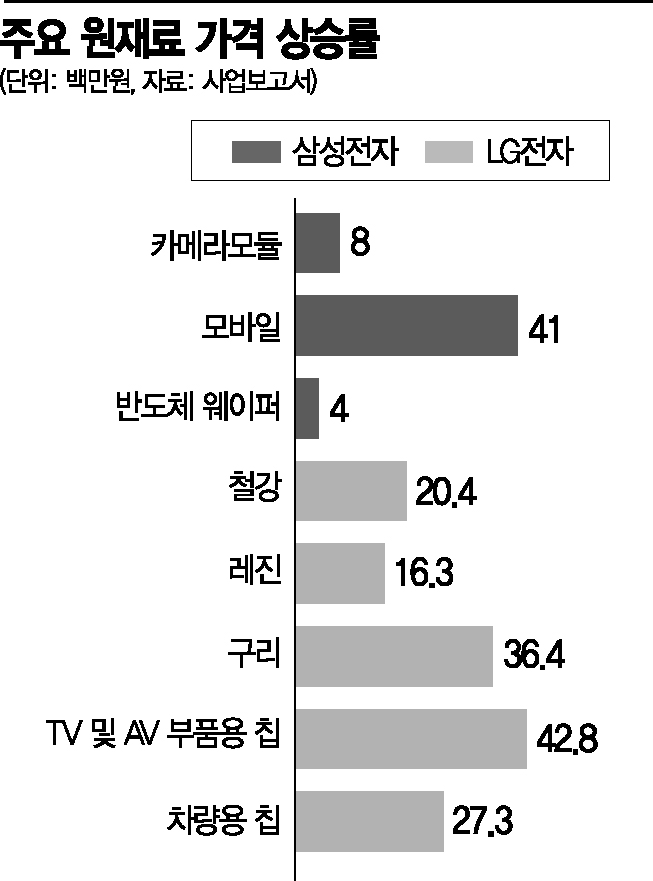

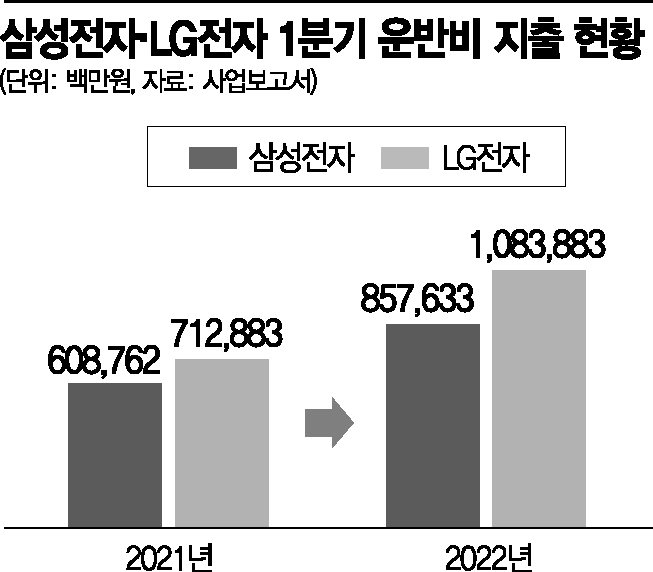

LG Electronics disclosed in its first-quarter business report this year that prices of steel, resin, and copper used as raw materials for home appliances rose by 20.4%, 16.3%, and 36.4%, respectively, compared to the same period last year, and various semiconductor chip prices increased by 20-40%. The product transportation costs incurred by Samsung Electronics and LG Electronics in the first quarter of this year also rose by 41% and 52% compared to last year, reaching 857.6 billion KRW and 1.0838 trillion KRW, respectively.

There is also analysis that if China's Zero COVID policy leads to prolonged and strict city lockdowns, South Korea's economic growth rate could be affected.

The Korea International Trade Association's Institute for International Trade and Commerce predicted, "In the case of a full lockdown of regions accounting for 10% of China's GDP, South Korea's GDP growth rate would decline by 0.06 percentage points (6 weeks) to 0.11 percentage points (10 weeks) depending on the lockdown duration." Shanghai and Beijing, which have already been locked down, account for 7.4% of China's GDP. Furthermore, if lockdowns expand to Guangdong, Jiangsu, and other areas, covering regions that make up 30% of China's GDP for 8 weeks, South Korea's GDP growth rate could fall by 0.26 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.