Despite Inflation and Capital Outflow Concerns, Reserve Requirement Ratio Followed by LPR Rate Cut

Full Effort to Stimulate Economy as 5.5% Growth Target Wavers

Market Forecasts This Year's Growth Rate to Drop to the 2% Range

[Asia Economy Reporter Kim Hyunjung] China has cut the Loan Prime Rate (LPR), which serves as the benchmark interest rate, in response to a sharp economic slowdown. Despite concerns over inflation and capital outflows, this move is interpreted as a strong commitment to defend the '5.5% economic growth' target, which was hit hard by the zero-COVID policy. However, the market expects that a short-term recovery will be difficult and forecasts that China's economic growth rate this year will fall to the 2% range.

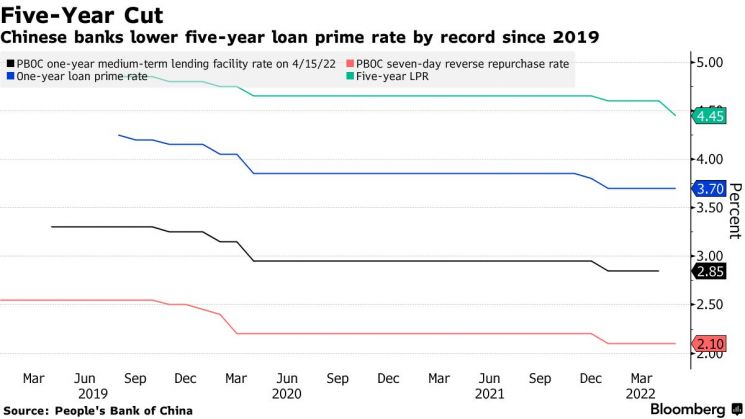

On the 20th, the People's Bank of China (PBOC), the country's central bank, announced that it would lower the 5-year LPR from 4.6% to 4.45%, a 0.15 percentage point cut. The 1-year LPR was held steady at 3.7%. The size of the cut exceeded the majority forecast (0.05 to 0.10 percentage points cut) from a Bloomberg survey of 19 economists, where 11 predicted a cut.

◆ LPR Rate Cut Following Reserve Requirement Ratio Reduction = The PBOC publishes the average LPR reported by 18 commercial banks on the 20th of each month, which all financial institutions in China use as the benchmark for lending operations. In particular, the 5-year LPR serves as the basis for calculating mortgage loan interest rates, making it an indicator that reflects China's determination to stimulate the economy, including the real estate market.

Western media had anticipated a possible cut in China's benchmark interest rate due to a sharp decline in new loan amounts. According to the PBOC, new loans in April amounted to 645.4 billion yuan (approximately 82.3 trillion won), a 79.4% decrease from the previous month (3.13 trillion yuan).

In a global environment where most countries are tightening monetary policy with rate hikes amid inflation concerns, China's decision to cut the LPR is seen as a sign of the seriousness of its economic situation. The PBOC has also accelerated liquidity easing by lowering the reserve requirement ratio by 0.25 percentage points on the 15th of last month.

◆ Forecasts of Growth Rate in the 2% Range This Year = As economic indicators such as retail sales (-11.1%) and industrial production (-2.9%) worsened significantly in April, global credit rating agencies and major economic research institutes have successively downgraded China's economic growth forecasts. Bloomberg Economics, a research institute under Bloomberg, sharply lowered China's growth forecast for this year from 3.6% to 2%. It predicted a contraction of 1.5% to 2.7% in the second quarter. Bloomberg also noted that while the Chinese government and the PBOC are expected to strengthen support, "the likelihood of easing the zero-COVID policy is slim, making it difficult to achieve even 5%, let alone 5.5% growth."

Standard Chartered (SC) stated that China's zero-COVID policy caused significant disruptions to production and consumption in April and early May, lowering its annual growth forecast from 5% to 4.1%. The second-quarter forecast was cut from 3.5% to 0.3%. SC predicted that "for every additional month of severe lockdown, the annual economic growth rate will fall by 0.6 percentage points." Additionally, Goldman Sachs lowered its forecast from 4.5% to 4%, and Citi cut its forecast from 5.1% to 4.2% on the 17th.

Meanwhile, according to Bloomberg News, based on the monetary and fiscal policies announced so far, the total fiscal amount China has pledged to inject for economic recovery reaches $5.3 trillion (approximately 6718.28 trillion won). This includes general budget expenditures, tax and fee reductions, policy loans, and the liquidity of hundreds of billions of yuan released by the PBOC through reserve requirement ratio cuts. Earlier, Premier Li Keqiang said at an economic work symposium held recently in Yunnan Province, "We must strengthen macro policy adjustments and ensure government agencies implement policies as soon as possible," adding, "We must strive to get the economy back on a normal track as quickly as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)