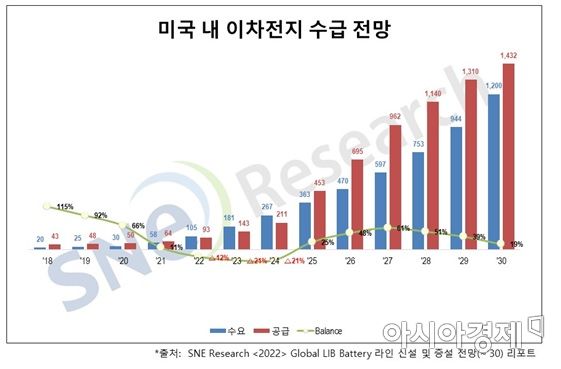

According to SNE Research, the demand for lithium-ion secondary batteries for electric vehicles in the United States in 2023 is expected to be 181 GWh, while the supply is projected to be 143 GWh, falling short of meeting the demand.

According to SNE Research, the demand for lithium-ion secondary batteries for electric vehicles in the United States in 2023 is expected to be 181 GWh, while the supply is projected to be 143 GWh, falling short of meeting the demand.

[Asia Economy Reporter Oh Hyung-gil] Due to the surge in demand for secondary batteries driven by the U.S. electric vehicle activation policy, a short-term supply shortage of U.S.-made secondary battery cells is expected.

According to SNE Research on the 19th, the demand for lithium-ion secondary batteries for electric vehicles in the U.S. in 2023 is 181GWh, while the supply is expected to be 143GWh, falling short of demand.

The U.S. is aiming to revitalize its domestic eco-friendly industry through the "Build Back Better Act." The electric vehicle activation clause allows an additional tax credit of $500 for electric vehicles that use U.S.-made secondary battery cells and have more than 50% of the final assembly parts sourced domestically.

Accordingly, major secondary battery companies are establishing new secondary battery factories in the U.S. However, due to the rapid increase in demand, it is explained that the U.S. secondary battery market will experience supply shortages until 2025.

Meanwhile, the demand for secondary batteries for electric vehicles in the U.S. is expected to increase to 453GWh by 2025 and 1200GWh by 2030.

The supply capacity of secondary batteries by manufacturers in the U.S. is predicted to grow from 64GWh in 2021 to 453GWh in 2025 and 1432GWh in 2030. By company, as of 2030, LG Energy Solution, SK On, and Samsung SDI are expected to reach 270GWh, 141GWh, and 133GWh respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)