Permanent Magnet Material Neodymium and Others

Annual Production of About 5,000 Tons Expected by Next Year

Cost Reduction Anticipated for Electric Vehicles and Phones

[Asia Economy Reporter Moon Chaeseok] South Korea has secured inbound foreign direct investment (FDI) from an overseas rare earth processing specialist company for the first time. By next year, it will be able to produce more than 5,000 tons annually of 'neodymium,' a raw material for 'permanent magnets' used in electric vehicles, wind turbines, and mobile phones. This is expected to enhance the stability of the domestic rare earth supply chain.

According to the government and industry sources on the 19th, KSM Metals, the Korean subsidiary of Australian rare metal mining and processing company ASM, completed a factory in Ochang, Chungcheongbuk-do on the 12th. This marks the first case of inbound FDI from an overseas rare earth company. Since it is a foreign company entering Korea rather than a Korean company going abroad, it is expected to bring benefits beyond investment, such as job creation, technology transfer, production capacity enhancement, and cost reduction.

KSM Metals' Ochang factory produces materials such as neodymium used in permanent magnets. Permanent magnets are raw materials widely used not only in electric vehicle drive trains and various parts but also in wind turbines, defense industry equipment, mobile phones, and electronic products. Given their diverse applications, once a stable production line is established, it is expected to contribute to cost reduction for various finished product companies.

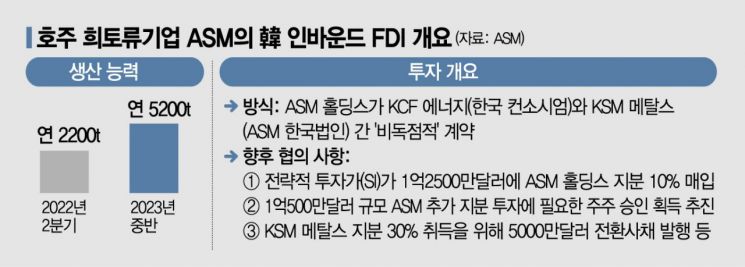

The factory's production capacity is planned to increase more than double from 2,200 tons annually in the second quarter to 5,200 tons by mid-next year. Currently, the first phase of equipment installation has been completed, and trial operations are underway. Initially focusing on neodymium, copper, and titanium metals, the factory plans to start producing core magnet alloys after completing the first phase of trial operations in the third quarter. The company expects that once the second phase of equipment installation is completed by mid-next year, annual production of 5,200 tons will be achievable.

The 'financial issue' will be addressed jointly by ASM Holdings and the Korean consortium KCF Energy. Funding required for investment in ASM, ASM Holdings, KSM Metals, and the supply of 'neodymium-iron-boron' alloys will be resolved through strategic investor (SI) attraction, shareholder approval, and convertible bond (BM) issuance. The challenge is to find an SI to purchase a 10% stake in ASM Holdings worth approximately $125 million (about 159.6 billion KRW) and to obtain shareholder approval for an additional ASM equity investment of about $105 million (about 134 billion KRW). Depending on customer demand, production focus may shift among electric vehicle trains, wind turbines, defense equipment, and mobile phones. ASM stated, "We cannot disclose the list of domestic customers."

With the attraction of an overseas rare earth specialist company to Korea, the government expects the domestic industrial supply chain to be further strengthened. At a meeting with Chey Tae-won, chairman of the Korea Chamber of Commerce and Industry, the Minister of Trade, Industry and Energy, Lee Chang-yang, said, "Investment (in facilities) is the part I care about the most," showing the government's commitment to expanding investment. An official from the Ministry of Trade, Industry and Energy said, "(Through this inbound FDI) we have established a foundation to produce rare earths domestically," adding, "Reviving the broken 'permanent magnet ecosystem' link is very significant."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.