Obstacles to Business Succession Due to Excessive Inheritance Tax Must Be Removed

[Asia Economy Reporter Park Sun-mi] There are claims that the current business succession tax deduction system hinders corporate business restructuring, investment, and innovation necessary for adapting to the times and survival. To adapt to changing times and survive, companies need to restructure their business and achieve innovation through investment, but the tax benefits conditioned on business continuity require reconsideration.

On the 19th, the Korea Economic Research Institute stated in its report titled "Review of Post-Conditions for Business Succession Tax Deduction in Line with Changing Times" that the post-conditions of the current business succession system need to be reconsidered.

To cope with rapid changes in the external environment, it has become important for companies to eliminate inefficiencies and minimize costs through business restructuring, while securing new growth engines that can turn crises into opportunities. In this process, continuous business restructuring such as industry specialization, diversification, and business transformation is essential.

The report pointed out that, given the rapidly changing characteristics of the times, judging that a company has not maintained continuity because it changed its industry or disposed of assets to invest in new businesses does not reflect corporate realities and should be improved.

Researcher Lim Dong-won of the Korea Economic Research Institute argued, “The asset disposal prohibition and industry maintenance requirements stipulated in the business succession tax deduction can act as obstacles to business restructuring (such as industry transition and diversification), and especially the stricter asset disposal prohibition compared to other systems can limit entry into and expansion of new industries, so it needs to be relaxed.”

The report proposed two institutional improvement measures. First, the industry maintenance requirement, which currently only allows changes within the medium classification, should be relaxed to allow changes within the large classification and eventually abolished in the long term. Since the Enforcement Decree of the Inheritance and Gift Tax Act has been amended to relax the industry change criteria during the business operation period (from medium classification to large classification), the post-conditions should also be revised to match the business operation recognition requirements.

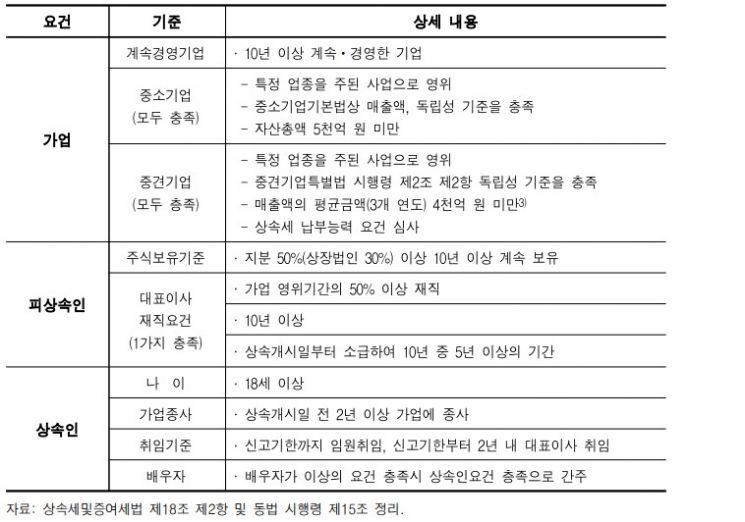

Second, the asset disposal prohibition requirement should be relaxed from the current prohibition of disposing of 20% or more to the continuity requirement of qualified mergers, which prohibits disposing of 50% or more, considering fairness with similar systems. Currently, inheritance tax on business succession acts as the biggest obstacle because it taxes unrealized gains arising from the transfer of the decedent’s property to the heir without changes to the corporate entity.

Researcher Lim stated, “In the long term, the business succession tax deduction system should be renamed ‘corporate succession deduction’ and allow deductions without restrictions on the applicable target, as in the UK, where companies held by the decedent for more than two years are eligible, and the deduction rate should be set between 50% and 100% without an upper limit.” He added, “As a fundamental alternative to the inheritance tax system, it is necessary to introduce a capital gains tax (taxation on succession acquisition value) that removes obstacles to business succession caused by excessive inheritance tax while maintaining tax fairness.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.