[Asia Economy Reporter Jeong Hyunjin] Tesla has been excluded from the S&P 500 ESG Index, which measures and discloses the ESG (Environmental, Social, and Governance) performance of U.S.-listed companies. As the world's largest electric vehicle manufacturer was excluded from a representative environmental index, Tesla CEO Elon Musk strongly opposed the decision, calling it a "scam."

On the 18th (local time), according to CNBC and other sources, U.S. stock index provider S&P Dow Jones announced that Tesla was removed from the S&P 500 ESG Index. S&P applied this change starting from the 2nd of this month and released the update on this day.

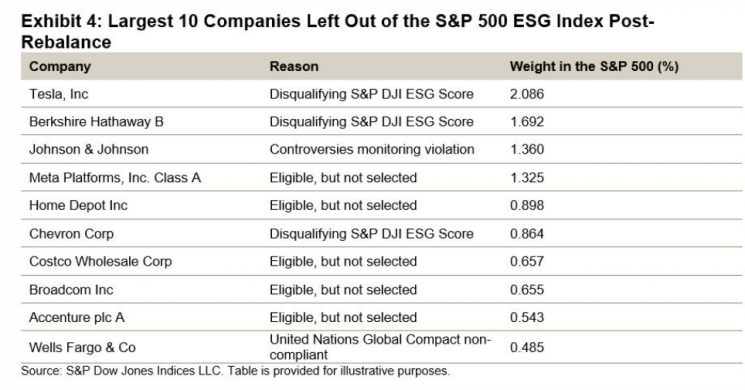

The S&P ESG Index ranks listed companies based on data related to environmental, social responsibility, and governance factors, providing this information to investors. Currently, companies such as Apple, Microsoft (MS), Amazon, Alphabet, Nvidia, and ExxonMobil are included, while Tesla, Berkshire Hathaway, Johnson & Johnson, Meta, and Chevron have been excluded from this index.

S&P cited reasons for Tesla's exclusion from the index, including poor working conditions and reports of racial discrimination at its Fremont, California plant, lack of a low-carbon strategy, and absence of a business code of conduct. CNBC also reported that Tesla's response to the U.S. National Highway Traffic Safety Administration (NHTSA) investigation contributed to its lower score.

Margaret Dunn, head of ESG for North America at S&P, explained, "While Tesla's electric vehicles contribute to reducing emissions on the road, from a broader ESG perspective, their efforts lag behind other competitors." She emphasized, "We cannot take a company's declarations about ESG efforts at face value; we must examine their practices across all dimensions."

Although Tesla contributes to accelerating the transition to sustainable energy through the expansion and adoption of electric vehicles, there have been incidents in management that are far from ESG principles. In February, Tesla reached an agreement with the U.S. Environmental Protection Agency due to years of violations of the Clean Air Act and inadequate tracking of its own carbon dioxide emissions. According to one research organization, Tesla's ranking in toxic gas emissions was higher compared to ExxonMobil.

Following the S&P announcement, Musk strongly opposed the decision. On his Twitter, he stated, "(Oil company) Exxon ranked within the top 10 in the ESG index. ESG is a scam," and claimed, "ESG has been weaponized by warriors who talk about fake social justice." Earlier, Tesla argued in its annual report last month that the ESG index is fundamentally flawed, and Musk also strongly criticized it the same month, calling "corporate ESG the embodiment of the devil."

On the day of the ESG index exclusion and amid concerns over inflation leading to a sharp decline in tech stocks, Tesla closed the market down 6.80% from the previous day at $709.81.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.