[Asia Economy Reporter Lee Seon-ae] As the earnings season for listed companies has come to an end, the intensity of 'earnings surprises' has weakened. With domestic companies expected to experience a decline in profit momentum in the 2nd to 4th quarters as well, a 'fundamentals-driven market' centered on companies steadily building stable earnings is expected to become more pronounced.

According to financial information provider FnGuide on the 17th, as the disclosure of 1st quarter reports for December fiscal year-end corporations was completed the day before, the intensity of earnings surprises has weakened compared to the 1st quarter of last year. As of the 15th, among the companies within the KOSPI 200 with consensus estimates, about 120 companies have announced their earnings, and the number of companies exceeding the earnings consensus based on total sales of the KOSPI 200 was approximately 59.6%, slightly down from 61.9% in the 1st quarter of last year. Looking at detailed sectors, the sales surprise ratio in the industrials sector fell from 56% in the last 1st quarter to 45%, and the IT sector also dropped from 82% to 58%. Additionally, the communication services sector declined from 55% to 42%, showing weaker sales surprise intensity compared to other sectors.

The intensity of earnings surprises in net profit declined even further. As of the 15th, 58.6% of companies announced net profit results exceeding consensus estimates, significantly lower than 75.4% in the 1st quarter of last year. By sector, the net profit surprise ratio in the financial sector dropped sharply from 100% in the last 1st quarter to 63% this quarter. Despite the strength of banks and insurance sectors due to the interest rate hike trend, the weakness in the securities sector is considered the cause. Additionally, the healthcare sector's net profit surprise ratio decreased from 67% in the last 1st quarter to about 38%. The materials sector fell from 90% to 65%, and the communication services sector dropped from 64% to 42%.

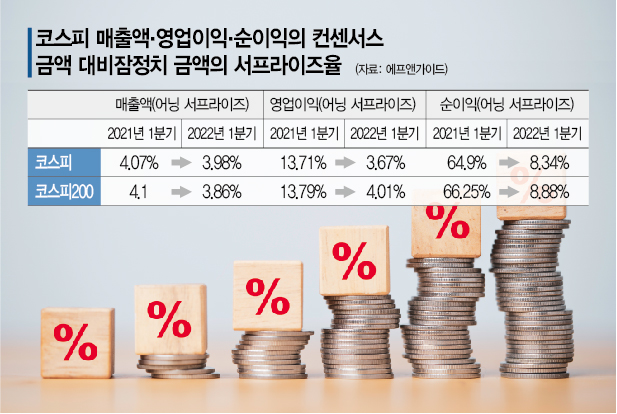

Due to the significantly lower surprise intensity in operating profit and net profit compared to the last 1st quarter, the provisional amounts relative to consensus for operating profit and net profit based on the KOSPI were only 3.67% and 8.34% above consensus, respectively. This is far below last year's 1st quarter surprise rates (operating profit 13.7%, net profit 64.9%) (however, it should be noted that last year's 1st quarter was distorted by the one-time accounting gain reflected by Naver).

Choi Jae-won, a researcher at Kiwoom Securities, said, "Although we need to see earnings announcements until the 16th, it is commonly confirmed that the intensity of surprises in operating profit and net profit has weakened across the market," adding, "While companies continue to show top-line growth in sales, the recently heightened inflationary pressures are becoming visible in the deterioration of corporate profitability." He further stated, "Since global inflationary pressures and supply chain issues persist, interest in companies that build stable earnings through higher profitability is expected to increase."

Currently, corporate earnings expectations are being revised downward. Among 130 KOSPI companies with consensus from three or more securities firms, 83 companies (64%) have seen their 2nd quarter operating profit estimates lowered compared to one month ago. Only 37 companies (28.4%) saw their operating profit estimates rise, while the remaining 10 companies (7.6%) showed no change. This indicates growing earnings uncertainty due to inflation, interest rates, international oil prices, the Ukraine crisis, and prolonged COVID-19 lockdown measures in China.

Na Jeong-hwan, a researcher at Cape Investment & Securities, expressed concern, saying, "If China's lockdown policies continue due to the spread of COVID-19, it could damage domestic exports and act as a factor slowing domestic corporate earnings," and added, "If the Russia-Ukraine war continues and energy and raw material prices remain high, domestic companies' operating profit margins will be revised downward."

At the beginning of the year, the operating profit margin forecast for KOSPI companies was about 9.3%, but it has now been revised downward to only about 8.3%. According to Kiwoom Securities, the earnings revision ratio (an indicator showing earnings forecast changes) for KOSPI 200 companies in the 2nd quarter is -5.22%. For the entire year, the earnings revision ratio is -4.56%, indicating that earnings momentum is expected to weaken even after the 2nd quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)