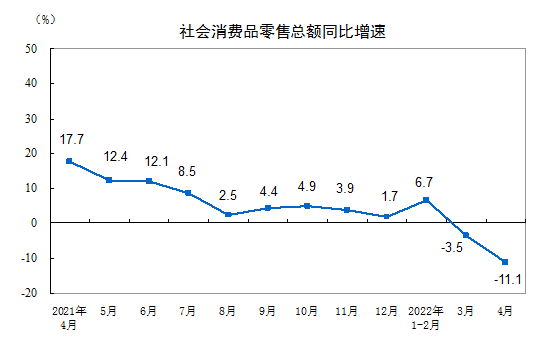

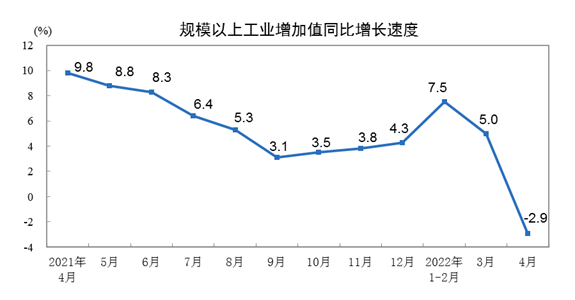

April Retail Sales Down 11.1%, Industrial Production Down 2.9%

Key Chinese Indicators Worsen in Sequence... Fiscal Stimulus Expected to Boost Economy

[Asia Economy Beijing=Special Correspondent Jo Young-shin] The bill for the Chinese government's 'Zero (0) COVID' policy has been issued. As expected, the sector that incurred the greatest cost was consumption.

China's National Bureau of Statistics announced on the 16th that the total retail sales amount in April was 2.9483 trillion yuan. This represents a staggering 11.1% decrease compared to the same month last year. Retail sales of consumer goods, excluding relatively large purchases such as automobiles, fell by 8.4% year-on-year to 2.6916 trillion yuan.

Domestic demand in China fully reflects the lockdowns

Retail sales sharply declined across both urban and rural areas. Urban retail sales plunged by 11.3% year-on-year, while rural retail sales also dropped by 9.8%.

Almost all surveyed items except food and pharmaceuticals?including automobiles, clothing, footwear, gold and silver jewelry, cosmetics, home appliances, and communication equipment?plummeted.

The item that contracted the most compared to the same month last year was automobiles. Last month, retail sales of automobiles in China amounted to 256.7 billion yuan, down a staggering 31.6% year-on-year. This was followed by gold and silver jewelry (-26.7%), clothing and footwear (-22.8%), cosmetics (-22.3%), communication equipment (-21.8%), furniture (-14.0%), and home appliances (-8.1%) in order of consumption contraction.

The only categories that saw an increase in retail sales were grains and oils (10.0%), beverages (6.0%), pharmaceuticals (7.9%), and petroleum products (4.7%). Last month's retail sales in China can be described as survival consumption, reflecting the direct impact of the Chinese government's Zero COVID policy on consumption.

Industrial production also turned negative

China's industrial production in April decreased by 2.9% year-on-year. China's monthly industrial production had been on an upward trend since September last year (3.1%). In March, at the early stage of the COVID-19 resurgence, the growth rate slowed to 5% from 7.5% the previous month, showing signs of abnormality. This is the first time since the early pandemic period in January-February 2020 that China's industrial production has turned negative.

By sector, automobile manufacturing fell by a staggering 31.8% year-on-year, followed by general equipment manufacturing (-15.8%), rubber and plastics (-8.1%), metal products (-6.6%), and textiles (-6.3%) with significant declines.

By major product, automobiles (-43.5%), metal cutting machines (-19.0%), cement (-18.9%), computer equipment (-16.8%), power generation equipment (-15.7%), and semiconductors (-12.1%) saw substantial decreases.

Infrastructure investment growth rate also slowed

Despite the Chinese government's strong determination to stimulate the economy through infrastructure investment, fixed asset investment was also affected by the lockdowns. Last month, China's fixed asset investment decreased by 0.82% compared to the previous month. This indicates that infrastructure investment did not proceed normally due to lockdowns in major cities such as Shanghai.

China's fixed asset investment showed vitality with a 12.1% increase year-on-year in the cumulative period of January to February, but the monthly growth rate has been slowing. The National Bureau of Statistics explained that fixed asset investment from January to April increased by 6.8% year-on-year. The cumulative fixed asset investment from January to March rose by 9.3% year-on-year.

Key indicators that gauge the Chinese economy are significantly deteriorating due to the Zero COVID policy, leading to forecasts that achieving the Chinese government's economic growth target of around 5.5% this year may be difficult.

Within China, voices are emerging that, given the unfavorable domestic and international environment?including the resurgence of COVID-19, rising international raw material prices, global inflation, and the Russia-Ukraine war?priority should be placed on domestic demand through fiscal policy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.