First Official Meeting Between Choo Kyung-ho and Lee Chang-yong After Inauguration

Strengthening Cooperation on Economic Uncertainty... Shared Recognition of the Need for Comprehensive Policy Response to Inflation

"Meeting Is Meaningless If It's Just an 'Excuse' for Choo Kyung-ho"... Some Express Concerns Over Genuine Cooperation

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho and Bank of Korea Governor Lee Chang-yong are attending a breakfast meeting held at the Press Center in Jung-gu, Seoul, on the morning of the 16th and posing for a commemorative photo. Photo by Kim Hyun-min kimhyun81@

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho and Bank of Korea Governor Lee Chang-yong are attending a breakfast meeting held at the Press Center in Jung-gu, Seoul, on the morning of the 16th and posing for a commemorative photo. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Sejong=Reporters Kwon Haeyoung and Moon Jewon] On the 16th, Lee Chang-yong, Governor of the Bank of Korea, mentioned that it is difficult to completely rule out a 'big step (0.50% point increase in the base interest rate)' in South Korea, reflecting a serious recognition that domestic inflation and exchange rate movements are beyond expected ranges. With U.S. inflation soaring to the 8% range, if the U.S. Federal Reserve (Fed) fully implements big steps, domestic inflation, capital outflows, and sharp exchange rate surges could intensify, meaning the Bank of Korea has also kept the big step as one of its options.

◆Bank of Korea Opens Possibility of Big Step=After a breakfast meeting with Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho at the Korea Press Center in Jung-gu, Seoul, Governor Lee indicated the possibility of a big step regarding the base interest rate hike, saying, "We need to comprehensively review data on how much inflation will rise going forward." This is the first time the Bank of Korea has revealed the possibility of a big step amid the Fed's de facto confirmation of big steps at the June and July Federal Open Market Committee (FOMC) meetings.

Governor Lee had previously stated at the National Assembly confirmation hearing on the 19th of last month that "I do not think it is necessary yet" regarding the possibility of a big step. However, with the U.S. April Consumer Price Index (CPI) exceeding market expectations earlier this month and forecasts emerging that the Fed might take a 'giant step' by raising the base rate by 0.75% points at once, it is analyzed that Governor Lee's stance has somewhat changed amid this urgent situation.

However, since a rapid rate hike could negatively impact domestic economic growth, it is uncertain whether a big step will be taken immediately in May. Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "It would be best if a big step does not occur, but in unavoidable situations such as a Korea-U.S. interest rate inversion, it seems impossible to completely rule out a big step."

◆Will the Controversy Over Monetary and Fiscal Policy Discord Subside and Enable Policy Coordination?=Attention is focused on whether the controversy over the 'discord' between monetary and fiscal policies will subside following this meeting. Deputy Prime Minister Choo and Governor Lee agreed to strengthen policy coordination regarding recent economic uncertainties and instability in foreign exchange and financial markets. They particularly agreed that comprehensive policy responses are necessary as the recent sharp rise in inflation could act as a macroeconomic burden.

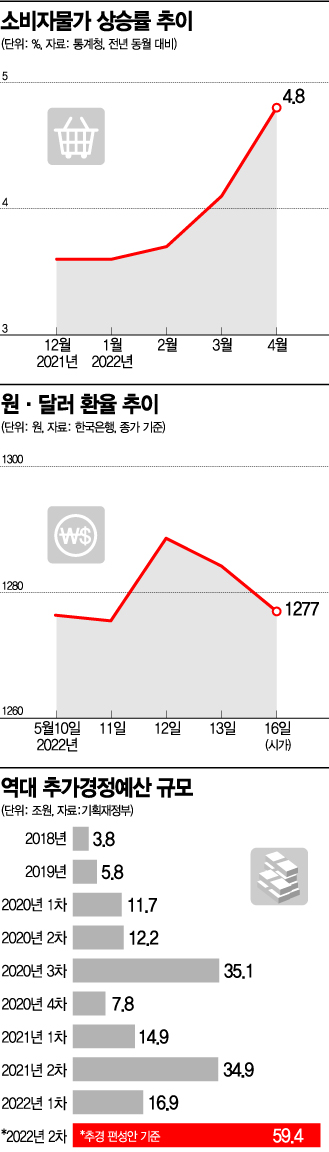

However, some voices remain concerned about whether real policy coordination between fiscal and monetary authorities can be achieved. While the Bank of Korea has raised interest rates in line with the global tightening trend, the government has pursued the opposite policy by repeatedly preparing supplementary budgets (Chugyeong), effectively 'distributing cash.' The supplementary budget announced immediately after the inauguration of the Yoon Seok-youl administration amounted to 59.4 trillion won, greatly exceeding the 35.1 trillion won of the third supplementary budget in 2020, which was the largest ever. The massive liquidity unleashed by the supplementary budget is likely to further push up the consumer price inflation rate, which exceeded 4.8% last month due to the Ukraine crisis and rising international grain prices.

Regarding concerns about policy discord and inflation stimulation, Deputy Prime Minister Choo explained, "We are working with the Bank of Korea to create an appropriate and optimal policy mix related to overall inflation and macro stability, and we are also considering comprehensive inflation stabilization measures." He added, "Although it cannot be said that there is no concern about inflation stimulation, this time the supplementary budget focused on previous expenditures, so the impact on inflation will not be that significant."

Professor Kang Sung-jin of Korea University’s Department of Economics said, "It is good that the Deputy Prime Minister and the Bank of Korea Governor meet to discuss economic issues and coordinate policies, but the key is whether this is reflected in actual policies afterward." He evaluated, "If this meeting serves as an 'excuse' for the government to increase liquidity, it is meaningless." He emphasized, "Even if this supplementary budget was inevitable due to political reasons such as election pledges, no further fiscal expansion should be made in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)