Survey of 150 Professors in Social Sciences at Metropolitan Universities

Rising Uncertainty..."Government Needs Active Policy Response"

Supply chain disruptions due to the COVID-19 pandemic, a financial crisis triggered by household loan defaults, and a hard landing of the Chinese economy were identified as the key risks to the South Korean economy. There are concerns that amid increasing global economic uncertainty, the South Korean economy could face a perfect storm (a massive complex crisis). It has been pointed out that the government needs to implement strong policy drives to prepare more proactive and effective countermeasures.

◆ Intensifying Global Supply Chain Disruptions... Top Priority = The Federation of Korean Industries (FKI) announced on the 16th that it conducted a survey through the polling agency Mono Research targeting 150 professors in economics and business fields at universities in the Seoul metropolitan area on the “economic risks that the Yoon Suk-yeol administration should keep in mind.”

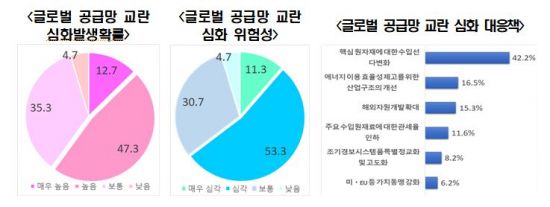

More than half of the responding professors expressed the greatest concern about the negative impact on the Korean economy caused by “intensified supply chain disruptions due to escalating US-China conflicts and prolonged Ukraine crisis.” The proportion of respondents who believed the likelihood of this issue occurring was 60%. Additionally, nearly 65% of respondents said the risk to the Korean economy if it occurs would be severe.

When asked about necessary countermeasures against supply chain disruptions, “diversification of import sources for key raw materials” (42.2%) was chosen as the most important policy. This was followed by improving industrial structure to enhance energy efficiency (16.5%) and expanding overseas resource development (15.3%).

In particular, the possibility of a financial crisis triggered by household loan defaults, identified as the biggest time bomb for the Korean economy, was also raised. Over the past five years of an unprecedented low-interest-rate era, household debt reached 1,862 trillion won as of the end of last year.

More than half of the professors responded that the likelihood of an economic crisis caused by household debt was high. The proportion of respondents who said the risk to the Korean economy if it occurs would be severe was 50%. Effective solutions proposed by the professors for household debt included raising the base interest rate (28.5%) and strengthening households’ financial resilience through employment expansion.

◆ China, Concerns Over Aftershocks from Economic Recession = Professors anticipated that external risks, especially uncertainties in the Chinese economy, would negatively affect the Korean economy. This is interpreted as pointing out the vulnerability of the highly externally dependent Korean economy.

They viewed the likelihood of a hard landing of the Chinese economy?due to the bursting of the real estate bubble, excessive corporate debt collapse, and COVID-19 lockdowns?as high. Regarding policies the government should pursue in preparation for a worsening Chinese economy, “support policies for export diversification” (47.0%) was most frequently chosen. This was followed by building a stable financial system defense (29.5%) and strengthening domestic demand support measures in industries highly dependent on China (18.6%).

The possibility of stagflation (economic stagnation accompanied by rising prices), similar to the past oil shocks, was also considered high. Additionally, there were concerns about a high likelihood of “manufacturing contraction due to national greenhouse gas reduction policies.”

Choo Kwang-ho, head of the Economic Headquarters at FKI, said, “The new administration is launching amid a complex economic crisis as domestic and external uncertainties intensify. Given limited policy capacity, it is necessary to prioritize managing domestic and external risks with high likelihood and significant impact on our economy, such as intensified supply chain disruptions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.