Yoon Administration Provides a Total of 40.7 Trillion Won in Financial Support to Small Business Owners

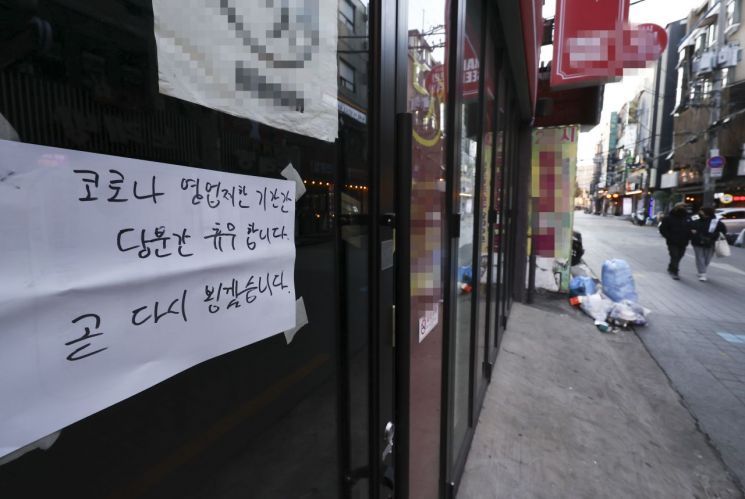

[Asia Economy Reporter Sim Nayoung] Financial policies are being promoted to increase policy fund loans for small business owners and to convert existing high-interest loans into low-interest loan products. The supplementary budget (supplementary budget) announced by the Yoon Seok-yeol administration on the 12th includes a plan for the government to provide a total of 40.7 trillion won in financial support for emergency financial aid and debt management for small business owners affected by COVID-19.

The supply of guaranteed loans provided by the Korea Credit Guarantee Fund or regional credit guarantee foundations will be increased by 3 trillion won in the form of special guarantees to provide emergency support to small business owners.

For small business owners who have taken out high-interest loans from non-bank sectors, refinancing loans will be supported to switch to lower interest rate loans. Low-credit borrowers will be assisted in converting existing high-interest loans into loans from the Small Enterprise and Market Service Promotion Fund. The conversion support scale is 200 billion won.

For medium-credit borrowers, conversion support will be provided through guarantee support from the Korea Credit Guarantee Fund, allowing loans up to 30 million won with interest rates up to about 7%. The conversion support scale is 7.5 trillion won. The Financial Services Commission stated, "The limits and interest rates are provisional estimates and will be finalized through future consultations with financial institutions."

A plan to restructure debts for small business owners who have difficulty repaying debts is also included in this supplementary budget. The government will create the "Small Business Owner and Self-Employed New Start Fund" (tentative name) using resources invested in the Korea Asset Management Corporation (KAMCO). The plan is to acquire 30 trillion won in potential non-performing loans among existing small business loans held by financial institutions by October. The government plans to restructure principal and interest debts on 10 trillion won of this amount.

Following the government's COVID-19 financial support policy, banks have been deferring principal and interest repayments on loans for small business owners since early 2020. The deferral measure is scheduled to end in September. Choi Sang-dae, Vice Minister of Strategy and Finance, stated, "The Financial Supervisory Service and financial institutions forecast that potential non-performing debts of small business owners will exceed 70 trillion won," adding, "We judged that measures for this part are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.