[Asia Economy Reporter Ji Yeon-jin] Although US inflation has confirmed its peak, concerns about stagflation, where rising prices and economic recession occur simultaneously, are spreading. The bond market, which has already experienced a tightening shock, is expected to see increased volatility at the end of this month when the Bank of Korea's Monetary Policy Committee meets.

According to the financial investment industry on the 14th, the US consumer price index (CPI) for April rose 8.3% year-on-year, slightly slowing from the previous month's 8.5% increase, confirming the peak of inflation.

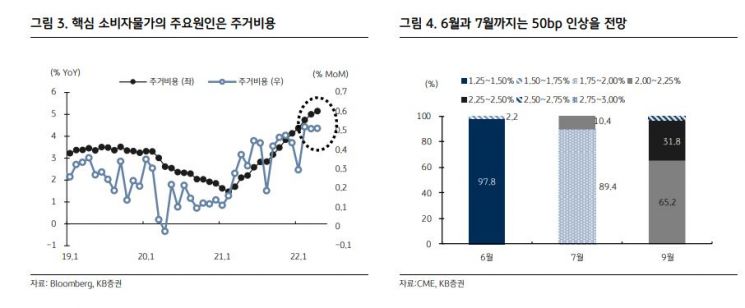

However, since it exceeded market expectations (8.1%), concerns about inflation remain as the consumer price increase continues. In particular, housing costs, which account for 41% of the core CPI, rose by 0.5%, suggesting that downward rigidity in prices is likely to increase.

Concerns that prices will not stabilize quickly have raised expectations for interest rate hikes by the US Federal Reserve (Fed). The market anticipates 'big steps' (rate hikes of 50 basis points or more) at the Federal Open Market Committee (FOMC) meetings not only this month but also in June and July.

Additionally, concerns about economic slowdown are spreading rapidly. The Bank of England (BOE) was the first central bank to mention the possibility of an economic slowdown during its monetary policy meeting in May. Former Fed Vice Chairs Clarida and Quarles stated that a recession is inevitable to control inflation, and following Minneapolis Fed President Neel Kashkari, Fed Chair Jerome Powell also hinted at the possibility of a recession on the 12th.

Financial markets are already reflecting stagflation. After the US April CPI announcement, US Treasury yields rose mainly in the short-term maturities and fell in the long-term maturities.

The Korean market is no different. Last month, domestic consumer prices rose 4.8%, the highest since 2008, and inflation is expected to intensify further. Researcher Lim Jae-gyun of KB Securities said, "In the revised economic outlook to be announced by the Bank of Korea in May, a downward revision of this year's growth rate from 3.0% is inevitable," adding, "Depending on the Monetary Policy Committee meeting scheduled for the 26th of this month and the consumer price announcement on the 3rd of next month, volatility in bond yields may occur."

However, if the Monetary Policy Committee raises interest rates at the end of this month, it could create the perception that the rate hike cycle has entered its latter phase, which may help restore investor sentiment. Moreover, among investors, there is a growing perception that the 3-year government bond yield exceeding 3% is excessive, and uncertainty over deficit bonds has also eased considerably, which could be positive for stabilizing investor sentiment in the short term.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.