[Asia Economy Reporter Jeong Hyunjin] The price collapse of TerraUSD (UST), a stablecoin issued by Terraform Labs, a blockchain company founded by Korean CEO Do Kwon, a former Apple engineer, is shaking the global cryptocurrency market worth approximately $1.5 trillion (about 1900 trillion KRW). The chaos that started with Terra is spreading to major cryptocurrencies such as Bitcoin, raising concerns that this could become the "Lehman Brothers crisis of the cryptocurrency world."

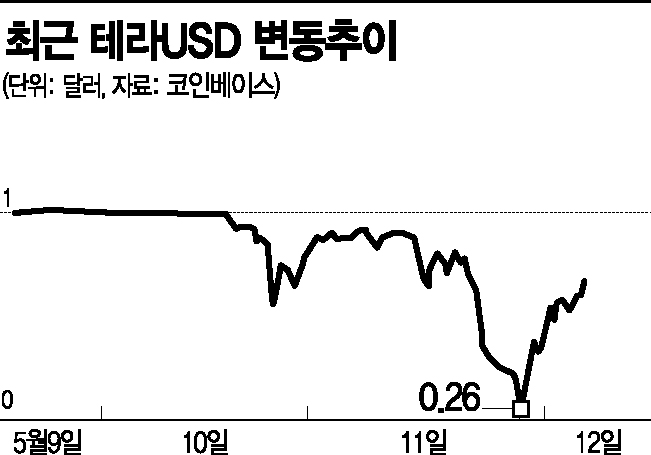

According to cryptocurrency exchange Coinbase on the 12th, as of around 9:10 AM KST, Terra is trading at $0.74. Terra had plunged to as low as $0.26 late the previous afternoon, shaking the market. Terra, a stablecoin designed to be pegged to the value of $1 per coin, meaning its value dropped to 26 cents.

As Terra plummeted, Luna, its sister cryptocurrency that helps maintain the stablecoin's value, also crashed to the $1 range. Luna had surged to the $110 range last month but then declined, losing more than 90% of its value within a week. Bloomberg reported, "Everything has collapsed," diagnosing that "Terra, once a darling of the DeFi (decentralized finance) world, is heading into a death spiral."

The collapse of Terra's price is dragging down Luna's price, and this phenomenon is triggering a vicious cycle of price declines for both coins.

Terra's crash is expected to act as a trigger in the cryptocurrency market. The Luna Foundation Guard, a nonprofit organization established to support Terra, holds billions of dollars worth of Bitcoin, and there is speculation that it may sell Bitcoin to supply liquidity for Terra. As a result, Bitcoin's price fell below the $30,000 mark on the day and continues to decline. The Daily Guardian reported on the incident, asking, "Is Terra's fall becoming the Lehman Brothers moment in the cryptocurrency market?"

Market attention is turning to the potential impact of this incident on the financial market. Since the U.S. Federal Reserve (Fed) and the U.S. Treasury have repeatedly emphasized that stablecoins pose potential risks to financial stability and that regulation is necessary, this incident is expected to serve as grounds for strengthening regulations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)