'Corona Obesity' Overlaps

Growth Trend in Obesity Drug Market

Danish Multinational Pharma Novo Nordisk

'Saxenda' Holds No.1 Market Share in Korea

Hanmi Pharm Completes Phase 3 Trials

Yuhan Corp and Humedix Also Developing

[Asia Economy Reporter Lee Chun-hee] As the demand to treat obesity as a disease through medication or injections increases, the entry of foreign pharmaceutical companies into the domestic market is accelerating. Domestic pharmaceutical companies are also increasingly entering the development of obesity treatments, and the obesity treatment market is expected to continue growing in the future.

According to the pharmaceutical industry on the 11th, Novo Nordisk, a Danish multinational pharmaceutical company, recently obtained domestic approval from the Ministry of Food and Drug Safety for the GLP-1 class type 2 diabetes treatment "Ozempic Prefilled Pen" (active ingredient semaglutide). Novo Nordisk plans to expand into the obesity treatment field by conducting a Phase 3a clinical trial in Korea on the weight loss effects of semaglutide for overweight and obese patients, in addition to the approved indication for diabetes.

The same company's "Saxenda" (active ingredient liraglutide) already holds the number one market share in the domestic obesity treatment market. Saxenda expanded its indication to obesity treatment after confirming weight loss effects during its development process beyond diabetes. Ozempic also showed weight loss effects beyond diabetes and was approved last year by the U.S. Food and Drug Administration (FDA) as an obesity treatment under the name "Wegovy." Although direct comparison is difficult, Wegovy demonstrated greater weight loss effects in more dosage groups in Phase 3 trials compared to the existing Saxenda.

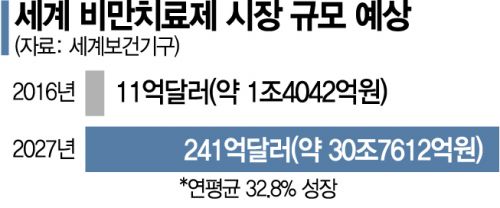

According to the World Health Organization (WHO), the global obesity treatment market is expected to expand to $24.1 billion (approximately 30.76 trillion KRW) by 2027. Especially with the overlap of "COVID obesity," where weight gain occurs due to reduced outdoor activity during the COVID-19 pandemic, the growth trend of the obesity treatment market is expected to be more pronounced. Overseas, Eli Lilly announced Phase 3 clinical trial results last month for "Tirzepatide," a dual-action inhibitor class drug including GLP-1 and gastric inhibitory polypeptide (GIP). Lilly reported that Tirzepatide reduced the weight of obese patients by up to 22.5%.

Domestic pharmaceutical companies have also started developing obesity treatments. Currently, in the domestic obesity treatment market, Saxenda holds about 25% market share, and Alvogen Korea's "Qsymia" (a combination of phentermine and topiramate) holds about 10%, with foreign products dominating the market.

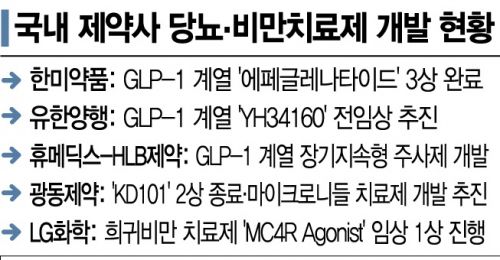

The frontrunner is Hanmi Pharmaceutical's GLP-1 treatment "Epeglenatide." It has completed Phase 3 trials and confirmed weight loss effects in addition to blood sugar control. Additionally, Yuhan Corporation plans to complete preclinical trials for the GLP-1 class "YH34160" within this year, and Humedix and HLB Pharmaceutical are also developing GLP-1 class obesity treatments.

There are also cases incorporating new technologies. Kwangdong Pharmaceutical, which has been developing a new drug "KD101" that inhibits adipocyte differentiation and accumulation through signal transduction pathways, recently started joint development of an obesity treatment with micro-needle platform company Quad Medicine. Micro-needles are a technology that attaches a patch with ultra-small needles to the body for simple administration, attracting attention for its higher medication convenience compared to existing injections or oral drugs.

Some in the medical community argue that obesity treatments should be covered by insurance. Professor Ko Hye-jin of the Department of Family Medicine at Kyungpook National University Hospital stated, "There are many difficulties in the field due to the lack of options for drug treatment as an intermediate step for patients who cannot undergo surgery or have fear of surgery," and argued that health insurance should support this. Overseas, countries such as the UK have recommended health insurance coverage for Saxenda and Wegovy. The government, considering priority comparisons with other diseases, has taken a negative stance, citing concerns about fairness controversies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.