Q1 Sales Up 71% Year-on-Year

Stock Price Rises 11% Over Last 5 Trading Days

PC Market Expected to Slow but Server Demand to Increase

Annual Revenue Forecast Raised 31% to $264 Billion

[Asia Economy Reporter Minji Lee] American semiconductor company Advanced Micro Devices (AMD) is showing higher growth in the first quarter compared to its competitor Intel, raising expectations for this year's performance. Securities experts predict that AMD's stock price will show an upward trend as the company itself has raised its performance outlook.

According to the financial investment industry on the 8th, AMD's stock price was $95.34 as of the 6th (local time). The stock price reacted after the company announced solid earnings following the market close on the 3rd, with a 5-day trading increase rate reaching 11%.

AMD recorded $5.89 billion in revenue for the first quarter, a 71% increase compared to the same period last year. This is the highest quarterly performance, exceeding market expectations by 17.6%. Earnings per share (excluding one-time gains) grew 124% to $1.01 during the same period. Operating profit increased 78% to $1.36 billion. Sales from Xilinx, which was acquired and finalized on February 14, were reflected at $560 million over six weeks.

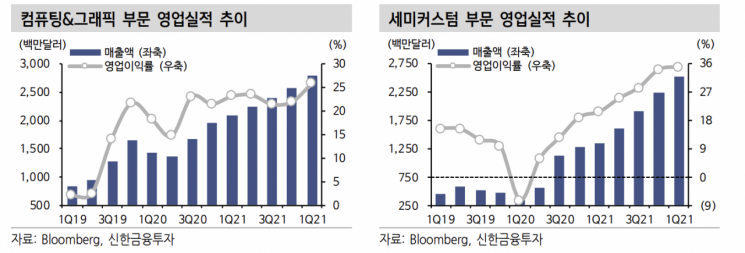

All business segments showed double-digit sales growth. Computer and graphics sales, accounting for 48% of total revenue, reached $2.8 billion, a 33% increase from a year ago. Despite growing concerns over a sharp decline in PC laptop demand, this marks the seventh consecutive quarter of record performance. Strong Ryzen CPU sales continued to drive growth compared to the previous quarter, while GPU sales slightly declined due to reduced demand for servers. However, both CPU and GPU average selling prices improved due to an increased share of high-end products.

Enterprise, embedded, and semi-custom segments (accounting for 43% of sales) recorded $2.5 billion in revenue, an 88% increase over the same period. Hyungtae Kim, a researcher at Shinhan Financial Investment, explained, “The penetration rate of EPYC processors for servers and data centers in cloud and enterprise markets has continued to increase,” adding, “The 3rd generation EPYC processors are being used for virtual machine upgrades in MS Azure and improvements in Google and AWS cloud HPC.” The company expects the semi-custom segment to achieve record-high performance this year as demand improves.

A notable aspect of this performance is the higher growth rate compared to competitor Intel. The segment with a large share of Intel's revenue is the Client Computing Group (CCG), related to PC semiconductors, which decreased by about 13% compared to the same period last year. As a result, the market is forecasting that AMD could surpass Intel's market capitalization. As of the 6th, AMD and Intel's market capitalizations are $66 billion and $181.143 billion, respectively.

The company's guidance for the second quarter projects revenue of $6.5 billion, exceeding market expectations of $6 billion. The annual revenue guidance was raised by 31% to $26.4 billion, reflecting the Xilinx acquisition and strong server demand.

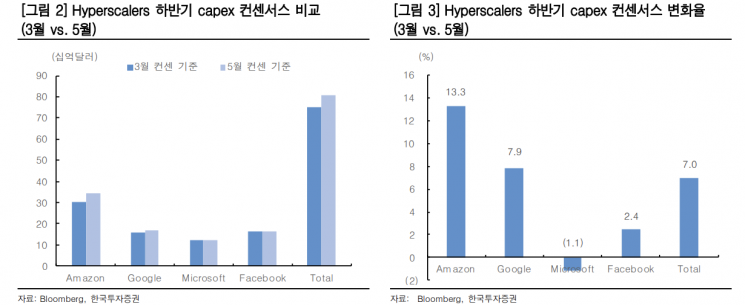

AMD acknowledged a slowdown in the PC market this year. However, it expects this to be offset by increased penetration of high-end products and growing server demand. CEO Lisa Su stated, “Next-generation server CPU Genoa is scheduled for release in the second half of the year, which will drive replacement demand from hyperscalers (large cloud service providers such as Google and AWS),” adding, “We are minimizing supply chain issues through cooperation with partners, and although there are water shortage issues in Xilinx's processes above 16nm, we are resolving them.”

Sangsoo Park, a researcher at Korea Investment & Securities, emphasized, “Although there are short-term concerns about profitability deterioration due to foundry price increases, improvements in product mix and strong server demand will offset this,” and added, “It is reasonable to maintain a positive view on AMD.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.